Woman on Board(s)

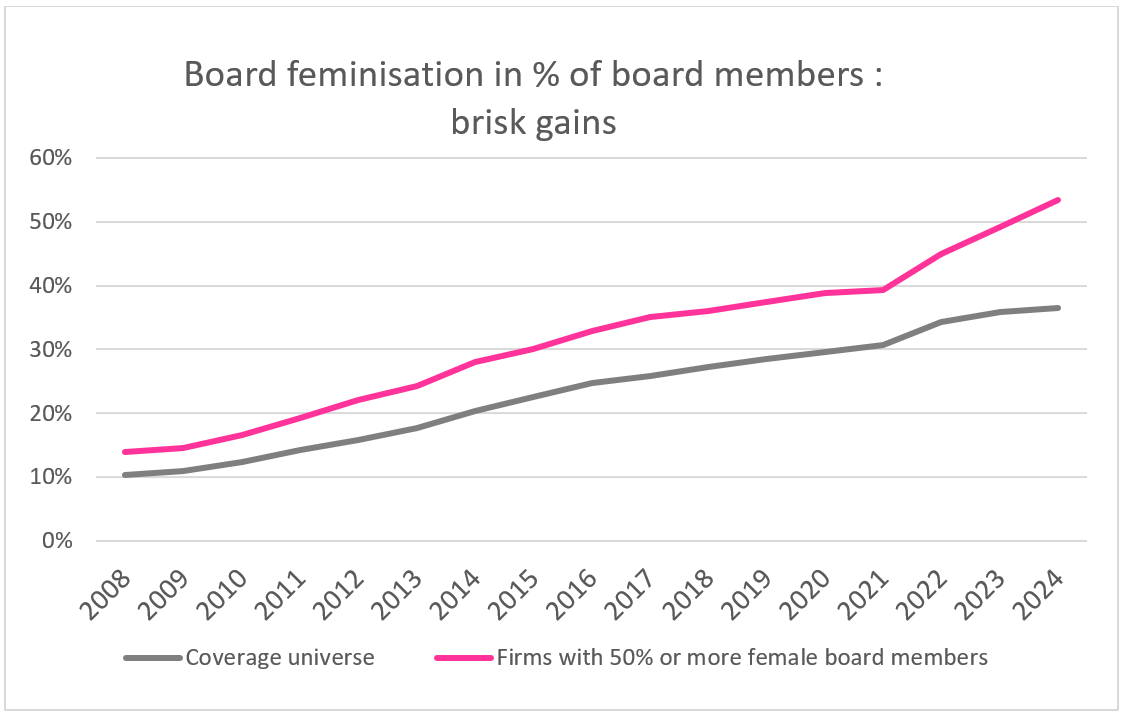

Alphavalue identifies 81 European stocks under coverage (of the 574 for which is has proprietary data) where female board members account for 50% or more of the directors.

For the whole coverage. the average percentage of women is 36%. It used to be 10% back in 2008. So the progress has been significant. AlphaValue regards as progress any sign that boards are open-minded governance bodies. The participation of women is the most obvious metric.

For the issuers where the current ratio of women sitting on the board is 50% or above, the average ratio is 53%, up from 14% back in 2008. These firms started with a higher percentage but record roughly the same rate of progress.

Since 2012 AlphaValue has held the view that the pace of feminisation was so strong (mostly achieved through law & regulation, remember) that it would no longer be in a position to measure a performance impact. Looking over any period, the issue is not the proportion of women at board level but the size of the corporate: smaller ones have underperformed on most time horizons. For the sake of providing figures, the weighted average performance over 3 years of the 81 issuers whose boards are dominated by women will be +47%. But only +12% on a median basis, i.e. smaller caps do poorly with or without women's added intelligence.

There are other more intuitive items that can be cross-checked. One is whether boards with more women do better on the environmental front. Just possibly is the answer as environmental scoring is still pretty unstable and above all there are 1,000 ways to skin that cat.

To cope with the weakness in the structural environmental data, AlphaValue relies on its own data, uses simple metrics and above all wants all corporates to be comparable on the environmental front. On that basis, women-dominated boards seem to steer companies toward more greenery in relative terms (vs. the wider universe), but not in dynamic terms (progress over years) as shown in the next table. Obviously environmental data is recent, unstable and fallible meaning that a series as short as below does not convey any final message. The best that can be said is that more women on boards does not hurt.

Female dominated boards issuers : better environmental scores?

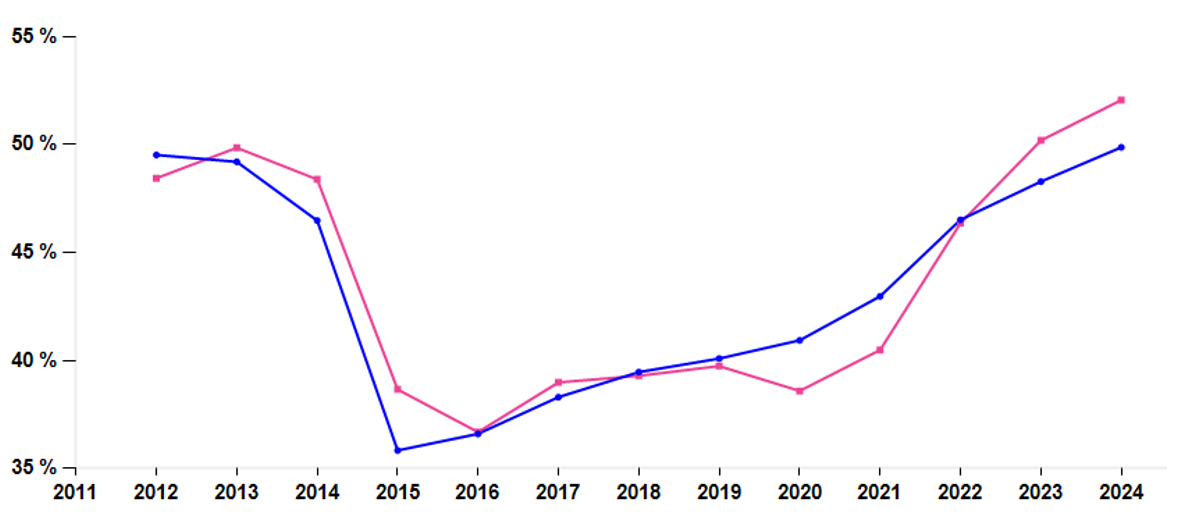

Are boards populated by women more independent?

The answer is a disappointing "No". AlphaValue’s definition of independence is rather strict and strives to free itself from local definitions and corporate abuse of the concept (see our criteria). Interestingly the 81-strong universe relying on women-driven governance shows no gap at all with the market when it comes to the proportion of independent directors. Women are just as tied as their male peers. It is also fascinating to see that independence comes and goes along the same cycle.

Proportion of independent directors for women-dominated boards (pink) vs. market - 2012-2024

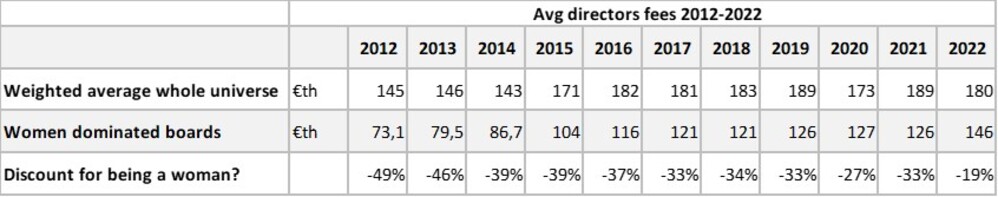

To close this ‘women on boards‘ chapter with a comment on money, i.e. directors' fees, it still does not pay to be a female director even though the gap would seem to be closing i.e. female director fees seem to be rising more rapidly from a low base than for the average board. The figures below are treacherous to manipulate as data consistency is wanting but the gap and trends are clear.

Overall, it looks as if the benefits of the inclusion of women in corporate boards are not being compensated, for female directors as well as for the shareholders they represent (more independence, better ESG marks, better strategies).

For the whole coverage. the average percentage of women is 36%. It used to be 10% back in 2008. So the progress has been significant. AlphaValue regards as progress any sign that boards are open-minded governance bodies. The participation of women is the most obvious metric.

For the issuers where the current ratio of women sitting on the board is 50% or above, the average ratio is 53%, up from 14% back in 2008. These firms started with a higher percentage but record roughly the same rate of progress.

Since 2012 AlphaValue has held the view that the pace of feminisation was so strong (mostly achieved through law & regulation, remember) that it would no longer be in a position to measure a performance impact. Looking over any period, the issue is not the proportion of women at board level but the size of the corporate: smaller ones have underperformed on most time horizons. For the sake of providing figures, the weighted average performance over 3 years of the 81 issuers whose boards are dominated by women will be +47%. But only +12% on a median basis, i.e. smaller caps do poorly with or without women's added intelligence.

There are other more intuitive items that can be cross-checked. One is whether boards with more women do better on the environmental front. Just possibly is the answer as environmental scoring is still pretty unstable and above all there are 1,000 ways to skin that cat.

To cope with the weakness in the structural environmental data, AlphaValue relies on its own data, uses simple metrics and above all wants all corporates to be comparable on the environmental front. On that basis, women-dominated boards seem to steer companies toward more greenery in relative terms (vs. the wider universe), but not in dynamic terms (progress over years) as shown in the next table. Obviously environmental data is recent, unstable and fallible meaning that a series as short as below does not convey any final message. The best that can be said is that more women on boards does not hurt.

Female dominated boards issuers : better environmental scores?

Are boards populated by women more independent?

The answer is a disappointing "No". AlphaValue’s definition of independence is rather strict and strives to free itself from local definitions and corporate abuse of the concept (see our criteria). Interestingly the 81-strong universe relying on women-driven governance shows no gap at all with the market when it comes to the proportion of independent directors. Women are just as tied as their male peers. It is also fascinating to see that independence comes and goes along the same cycle.

Proportion of independent directors for women-dominated boards (pink) vs. market - 2012-2024

To close this ‘women on boards‘ chapter with a comment on money, i.e. directors' fees, it still does not pay to be a female director even though the gap would seem to be closing i.e. female director fees seem to be rising more rapidly from a low base than for the average board. The figures below are treacherous to manipulate as data consistency is wanting but the gap and trends are clear.

Overall, it looks as if the benefits of the inclusion of women in corporate boards are not being compensated, for female directors as well as for the shareholders they represent (more independence, better ESG marks, better strategies).

Subscribe to our blog

Hal Trust's strategy consists of acquiring and holding significant stakes in companies where it ...

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …