Reinsurers

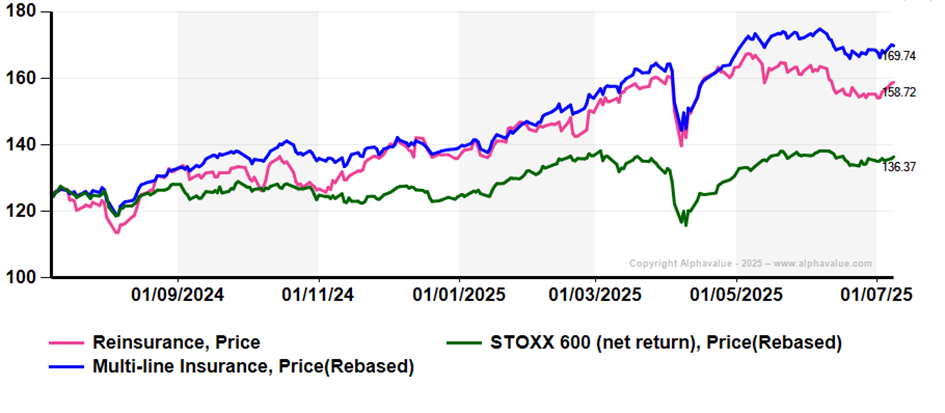

Of late Reinsurers have lost out to their primary cousins (see performance chart). The talk is that reinsurance prices (‘treaties’) are no longer those of a sellers’ market. Prices in reinsurance is a hard-to-track concept as they must be risk-weighted to make any sense so that they cannot be easily compared from one issuer to the next.

Still the message has been heard that the heyday of substantial price increases are now behind us.

Reinsurance capitulates to insurers?

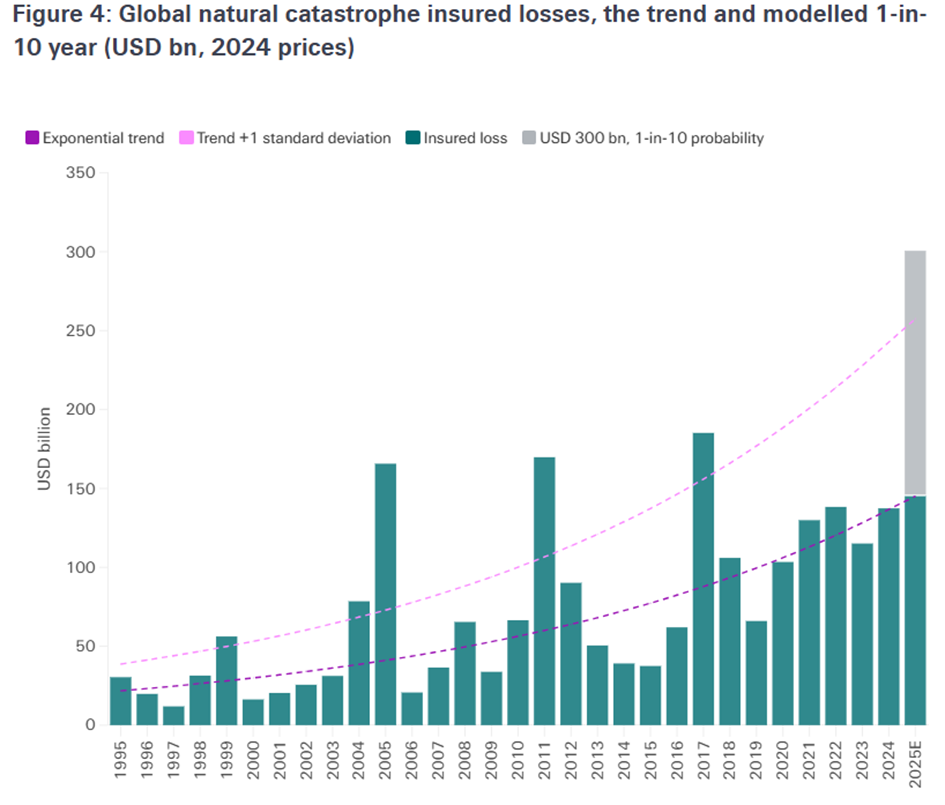

It is with this in mind that Swiss Re's just-released annual review of the reinsurance markets (sri-sigma-natural-catastrophes-1-2025.pdf; a must-read) comes in handy. It suggests (and confirms) that there will be no shortage of insured losses coming tomorrow. The following chart

a) shows the existing exponential trend with a dab at $150bn insured losses this year and

b) models a 1-in-10 year extreme year.

This is quite striking and a good measure of why reinsurance exists.

One would expect demand for reinsurance to be quite healthy with the above chart in mind. Obviously supply becomes the next question. Swiss Re sees no capacity constraint i.e. $300bn disgorged in a 1-in-10 year bad year can be digested by Reinsurers. Presumably they have an issue if it develops into an annual occurrence.

Any mention of extra capital capacity will hinge on financial markets/Bermudian. The quote is another $50bn in the shape of cat bonds loss absorbing capital plus possibly another $110bn from various punters (Howden data).

The near-term issue is that reinsurance capital is not growing fast at reinsurers (good for prices through scarcity) but is facing plenty of excess capital at primary insurers which have had quite a number of bumper years and have provided less cover at the expense of the insured parties. In effect, Reinsurers are facing competition from their clients…

With the benefit of hindsight, the previous observation implies that insurers and their own insured clients cannot spend more on risk transfer and will, sort of, self insure instead. That is the equivalent of deploying more capital which nominally will not be supportive to reinsurance prices.

Still, it will take only a biggish nat cat event to remind everyone of why reinsurers exist in the first place. They have more free capital and a better set of tools to price risks than any would-be participant. Furthermore they operate as an oligopoly.

Stay put and remember that climate events are the reinsurers’ best friends to justify charging more.

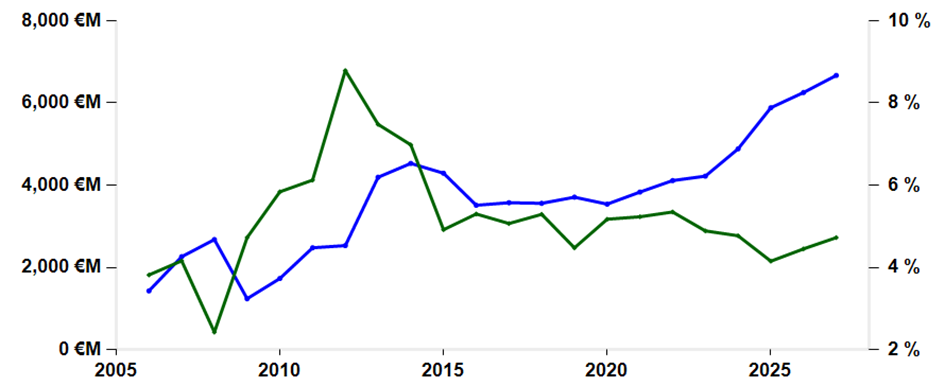

The following chart is a reminder that, come rain or shine, Reinsurers will pay up (dividends only in chart). That matters.

Reinsurers dividends (en masse, in blue) and their yield (green, 2006-2027)

Still the message has been heard that the heyday of substantial price increases are now behind us.

Reinsurance capitulates to insurers?

It is with this in mind that Swiss Re's just-released annual review of the reinsurance markets (sri-sigma-natural-catastrophes-1-2025.pdf; a must-read) comes in handy. It suggests (and confirms) that there will be no shortage of insured losses coming tomorrow. The following chart

a) shows the existing exponential trend with a dab at $150bn insured losses this year and

b) models a 1-in-10 year extreme year.

This is quite striking and a good measure of why reinsurance exists.

One would expect demand for reinsurance to be quite healthy with the above chart in mind. Obviously supply becomes the next question. Swiss Re sees no capacity constraint i.e. $300bn disgorged in a 1-in-10 year bad year can be digested by Reinsurers. Presumably they have an issue if it develops into an annual occurrence.

Any mention of extra capital capacity will hinge on financial markets/Bermudian. The quote is another $50bn in the shape of cat bonds loss absorbing capital plus possibly another $110bn from various punters (Howden data).

The near-term issue is that reinsurance capital is not growing fast at reinsurers (good for prices through scarcity) but is facing plenty of excess capital at primary insurers which have had quite a number of bumper years and have provided less cover at the expense of the insured parties. In effect, Reinsurers are facing competition from their clients…

With the benefit of hindsight, the previous observation implies that insurers and their own insured clients cannot spend more on risk transfer and will, sort of, self insure instead. That is the equivalent of deploying more capital which nominally will not be supportive to reinsurance prices.

Still, it will take only a biggish nat cat event to remind everyone of why reinsurers exist in the first place. They have more free capital and a better set of tools to price risks than any would-be participant. Furthermore they operate as an oligopoly.

Stay put and remember that climate events are the reinsurers’ best friends to justify charging more.

The following chart is a reminder that, come rain or shine, Reinsurers will pay up (dividends only in chart). That matters.

Reinsurers dividends (en masse, in blue) and their yield (green, 2006-2027)

Subscribe to our blog

A week ago, Reckitt posted splendid Q3 sales lifted by emerging markets demand, while L’Oré...

AlphaValue resuscitated its 20-year Ebitda margin chart (ex Banks and Deep Cyclicals) and continu...