Flabbergasting Autos

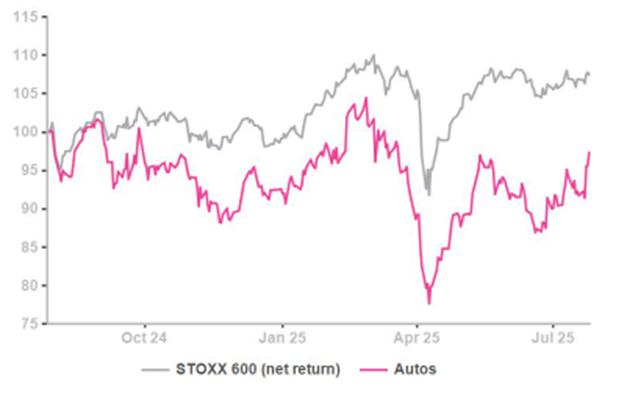

With the view that a 15% tariff is less painful than a 25% one, European Autos are feeling good. Investors seem to be willing to forget that only a few months ago, tariffs were nil and the US$ was 15% stronger, so that the same European export is now 30% more expensive to US consumers, leaving aside sundry costs. In addition, the Trump administration has caused chaos in the global car industry, as executives scratch their heads about their future industrial set-up and unsuited current supply chains. The disorder is ahead of us, but the European car sector gained 6% last week and 10% last month. With a 5% gain ytd, the sector is in positive territory.

The US scene is a developing mess. Now consider the European one. The Spanish media will flag a Jaecoo 7 mid-sized SUV with a 7-year warranty, a very European look, phenomenal autonomy and fully-fledged comfort features for €24,000, or half a Tesla Y price. The Omoda/Jaecoo brands (from Chery) are not identified as prime competitors, but this is the point. Chinese manufacturers facing excess capacity at home will not hesitate exporting their low prices to Europe with excellent cars. That is just the beginning. Remember that the industry leader BYD slashed its prices by 30% about a month ago.

It is hard to entertain the idea that European brands are strong enough to retain significant premium pricing. Even fleet purchasers will end up concluding that this Jaecoo7 is too good to miss, at the expense of BMW or Audi. Financially strapped European consumers, forced by emission regulations into EVs or hybrids, will inevitably consider a Chinese option. Chinese offers cannot be ignored through a flurry of ads. Alternatively if said consumers do not care about emissions, they will stick to their old bangers and make the second-hand car market even more of an active one (for Europe 22m units vs. 11m units for new cars). Whichever option, is not a great prospect for the European car industry.

AlphaValue keeps on expressing its doubts about the direction of travel of the European car industry. Now where does this leave us on the valuation front?

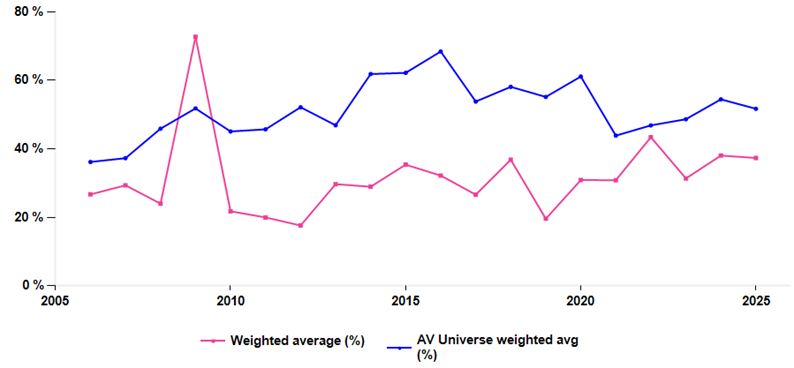

Sector PEs are unhelpful. A P/book approach provides more consistency over time. The following chart conveys the idea that the sector is seriously cheap at pixel time (Ferrari has been excluded as it is closer to a Luxury story).

Car manufacturers P/Book (pink) vs. market P/Book – 2006-2025

In parallel and may be paradoxically, the car industry is paying out more (dividend wise). This is not enough to prevent valuations from eroding. The dividend is good to have, but not regarded as recurring … Indeed AlphaValue anticipates that dividend payments will halve between 2024-2026 (Porsche AG excluded to avoid double counting through VW).

Car manufacturers Dividend Pay Out (pink) vs. market P/Book – 2006-2025

As long as volumes do not pick up, there is no benefit buying into European autos and hoping for the best. After all, it only takes hefty loses to trim the book value and raise the P/Book ratio to unpleasant levels. This happened in 2029-2010.

The US scene is a developing mess. Now consider the European one. The Spanish media will flag a Jaecoo 7 mid-sized SUV with a 7-year warranty, a very European look, phenomenal autonomy and fully-fledged comfort features for €24,000, or half a Tesla Y price. The Omoda/Jaecoo brands (from Chery) are not identified as prime competitors, but this is the point. Chinese manufacturers facing excess capacity at home will not hesitate exporting their low prices to Europe with excellent cars. That is just the beginning. Remember that the industry leader BYD slashed its prices by 30% about a month ago.

It is hard to entertain the idea that European brands are strong enough to retain significant premium pricing. Even fleet purchasers will end up concluding that this Jaecoo7 is too good to miss, at the expense of BMW or Audi. Financially strapped European consumers, forced by emission regulations into EVs or hybrids, will inevitably consider a Chinese option. Chinese offers cannot be ignored through a flurry of ads. Alternatively if said consumers do not care about emissions, they will stick to their old bangers and make the second-hand car market even more of an active one (for Europe 22m units vs. 11m units for new cars). Whichever option, is not a great prospect for the European car industry.

AlphaValue keeps on expressing its doubts about the direction of travel of the European car industry. Now where does this leave us on the valuation front?

Sector PEs are unhelpful. A P/book approach provides more consistency over time. The following chart conveys the idea that the sector is seriously cheap at pixel time (Ferrari has been excluded as it is closer to a Luxury story).

Car manufacturers P/Book (pink) vs. market P/Book – 2006-2025

In parallel and may be paradoxically, the car industry is paying out more (dividend wise). This is not enough to prevent valuations from eroding. The dividend is good to have, but not regarded as recurring … Indeed AlphaValue anticipates that dividend payments will halve between 2024-2026 (Porsche AG excluded to avoid double counting through VW).

Car manufacturers Dividend Pay Out (pink) vs. market P/Book – 2006-2025

As long as volumes do not pick up, there is no benefit buying into European autos and hoping for the best. After all, it only takes hefty loses to trim the book value and raise the P/Book ratio to unpleasant levels. This happened in 2029-2010.

Subscribe to our blog

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...