Suicidal Swatch

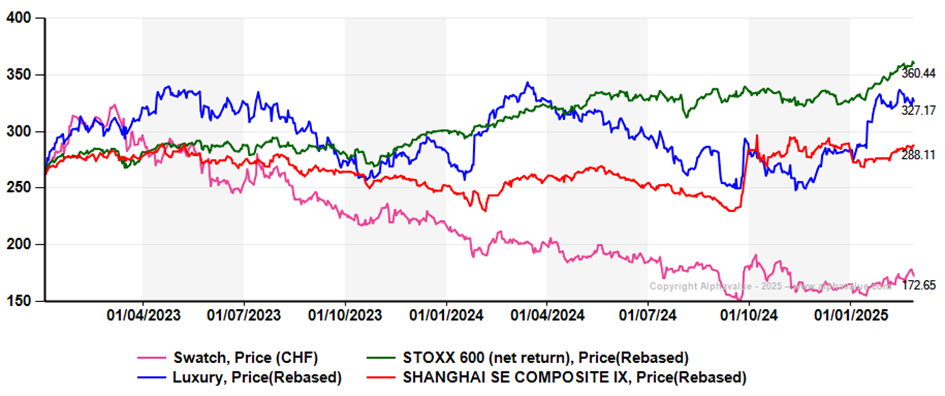

The Swatch share price has plunged by 47% since its peak in March 2023 and remains among the most-shorted stocks in Europe. The luxury watch industry faced strong headwinds in 2024, with weakening consumer appetite, a challenging macroeconomic environment in China and falling secondary market prices stalling momentum.

Swatch’s high exposure to China has further weighed on its trading performance, mirroring the trajectory of the SSE Index (see chart below).

Additionally, 'Swiss-made' comes with steep fixed costs. Staff expenses account for 37% of total sales and are not going south.

The group also missed the most critical window to leverage and amplify Omega's exclusive brand power amid a market favourable for ultra-exclusive luxury watches. While a handful of top-tier brands maintained positive growth, the broader industry struggled, leading Swatch to report a 75% decline in operating profit for 2024 last month.

Despite some hints of a recovery since December, as suggested by the management, the macroeconomic uncertainties persist and China’s market recovery shape remains more hope than fact. Add to this CEO Hayek’s unique communication style with capital markets and we do not expect a reversal in Swatch's share price momentum in the near term.

Uncertain recovery path in greater China

China’s macroeconomic challenges – including a stagnant property market, challenging employment conditions and rising concerns over pensions and healthcare – continue to depress consumer sentiment. This has led to reduced discretionary spending and lower traffic in mainland China, as well as decreased tourist spending in Hong Kong and Macau.

According to Bain & Company, China’s personal luxury market contracted by 18%-20% in 2024, with watches suffering the steepest decline, down by 28%-33%.

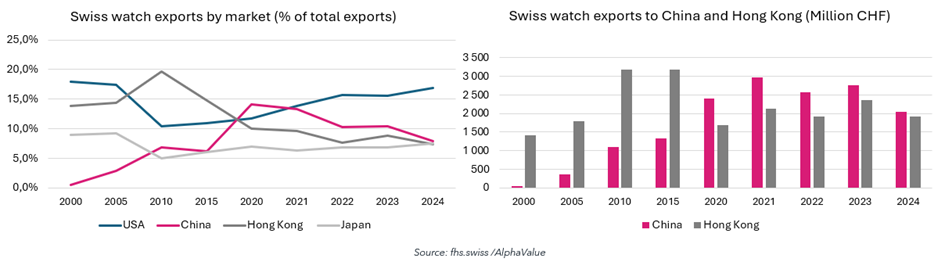

Swiss watch exports fell by 2.8% YoY to CHF 25.9bn, with exports to China and Hong Kong plunging by 25.8% and 18.7% YoY, respectively (chart below). China’s absorption of total exports shrank to 7.9% in 2024, down from 14.1% in 2020 (China & Hong Kong combined: 15.3% vs. 24.1% in 2020).

Swatch reported that sales in Greater China (including Hong Kong and Macau) dropped by 30%, reducing the region’s share of total sales to 27% from 33%. While the Q4 24 showed a slight improvement, possibly driven by Beijing’s ambitions to boost consumption, this may not last.

According to January data from the Federation of the Swiss Watch Industry, exports to China and Hong Kong continued to decline in double digits, despite the Chinese New Year starting on January 28. During the holiday period (Jan 28 – Feb 4), 900,000+ border crossings were recorded at the Hong Kong-Zhuhai-Macau Bridge, a historic high. However, despite the double-digit growth in visitor traffic, watch sales remained weak, further hurting confidence in the sector’s outlook.

Missing the luxury train

Swatch is banking on new opportunities for mid-range brands like Tissot, Longines and Hamilton.

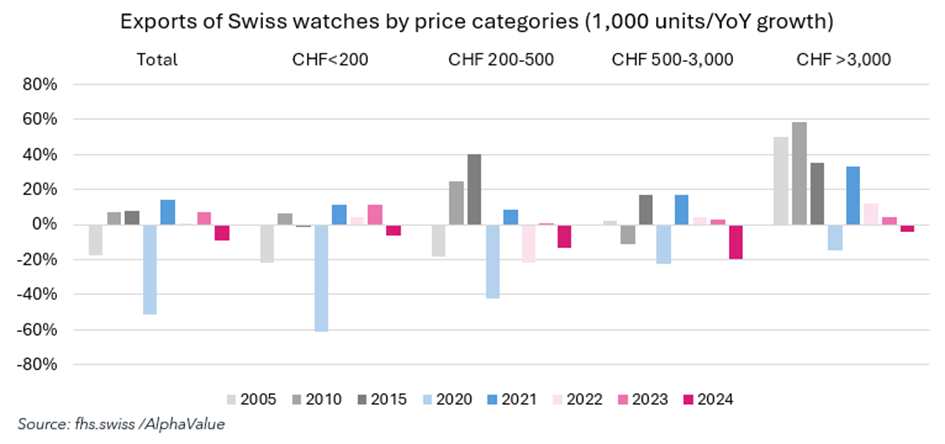

However, watches priced at CHF 200-500 have suffered most (see the chart below), largely due to competition from Apple Watch, which launched its first-generation model in April 2015. We see this downturn as structural, not cyclical.

Maintained demand for smartwatches continues to erode market share in this segment. Swatch has attempted to leverage its expertise in low-power, long-battery-life technology with the Tissot Smartwatch (2018) but has struggled to compete with the advanced wearables from Apple and Google.

A softer consumer environment (downtrading) won’t reverse the digital revolution Apple brought to the industry 10 years ago. We do not see much growth potential for mid-range watches moving forward.

Overshadowed Omega

We continue to believe that Swatch has missed a critical opportunity to leverage and amplify Omega’s exclusive brand power. Omega stands among the world’s most prestigious watch brands, alongside Rolex and Patek Philippe.

In October 2021, Partners Group Holding acquired a 25% stake in Breitling from CVC Capital Partners, valuing the brand at €2.9bn (5.8x its 2020 revenue). While these multiples need to be adjusted for today’s weaker market environment, Omega—accounting for close to 25% of Swatch’s sales (c.€1.5bn)—still holds substantial value. Even after a 30% discount to the Breitling multiple, Omega + Swatch's net cash position (CHF 1.1bn) could be valued at c.CHF7bn, not that far from Swatch's spot market cap.

Oddly Swatch has opted to prioritise investment in mid-range watch brands, leading to Omega’s losing ground to the industry peers.

The Hayek negative

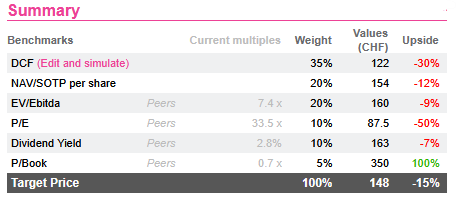

We slashed our earnings expectations following the disappointing H2 24 results and have adopted a more cautious stance on the stock. Our fundamental metrics indicate considerable downside potential.

A material inflexion point in the top-line momentum is sorely required. Sticking to Swiss-made production—even for lower-end products—is pressuring margins further. As a result, a profitability rebound is likely to take longer than expected.

In addition, the Hayek family with 25% of the capital and 43% of the voting rights remains at odds with the markets/minority shareholders.

CEO Nick Hayek has publicly expressed no intention of strengthening engagement with sell-side analysts and investors, nor does he plan to reinstate an Investor Relations department. He has repeatedly stated that “if investors dislike the company’s management or governance, they are free to invest elsewhere.” There is a conundrum in mentioning that a delisting would be a "nice thing to do" but that the family is unwilling to take on the debt required for a buyout.

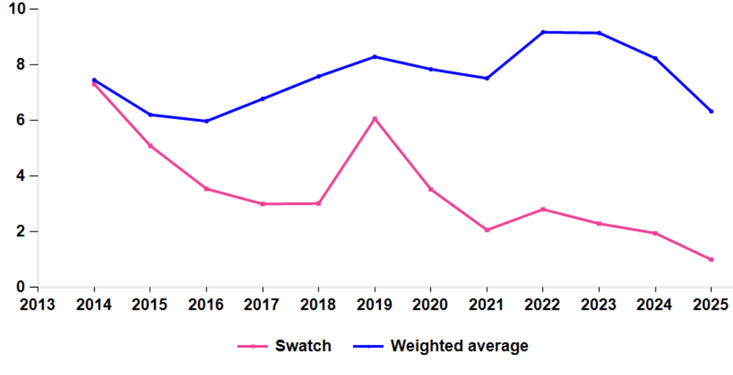

For AlphaValue, Swatch is a confirmation that family control is not always a win-win for minority shareholders. AlphaValue initiated coverage 15 years ago when Swatch was worth CHF100. Not much progress has been achieved since. The following chart, which tracks the fundamental strength of corporates, show how destructive the Hayek management has been over the last 12 years in an industry that has basked in growth.

Swatch fundamental strength (/10, in pink) vs. Luxury (blue)

If only the firm were to focus on its upscale brands, it would send the right growth message.

Swatch’s high exposure to China has further weighed on its trading performance, mirroring the trajectory of the SSE Index (see chart below).

Additionally, 'Swiss-made' comes with steep fixed costs. Staff expenses account for 37% of total sales and are not going south.

The group also missed the most critical window to leverage and amplify Omega's exclusive brand power amid a market favourable for ultra-exclusive luxury watches. While a handful of top-tier brands maintained positive growth, the broader industry struggled, leading Swatch to report a 75% decline in operating profit for 2024 last month.

Despite some hints of a recovery since December, as suggested by the management, the macroeconomic uncertainties persist and China’s market recovery shape remains more hope than fact. Add to this CEO Hayek’s unique communication style with capital markets and we do not expect a reversal in Swatch's share price momentum in the near term.

Uncertain recovery path in greater China

China’s macroeconomic challenges – including a stagnant property market, challenging employment conditions and rising concerns over pensions and healthcare – continue to depress consumer sentiment. This has led to reduced discretionary spending and lower traffic in mainland China, as well as decreased tourist spending in Hong Kong and Macau.

According to Bain & Company, China’s personal luxury market contracted by 18%-20% in 2024, with watches suffering the steepest decline, down by 28%-33%.

Swiss watch exports fell by 2.8% YoY to CHF 25.9bn, with exports to China and Hong Kong plunging by 25.8% and 18.7% YoY, respectively (chart below). China’s absorption of total exports shrank to 7.9% in 2024, down from 14.1% in 2020 (China & Hong Kong combined: 15.3% vs. 24.1% in 2020).

Swatch reported that sales in Greater China (including Hong Kong and Macau) dropped by 30%, reducing the region’s share of total sales to 27% from 33%. While the Q4 24 showed a slight improvement, possibly driven by Beijing’s ambitions to boost consumption, this may not last.

According to January data from the Federation of the Swiss Watch Industry, exports to China and Hong Kong continued to decline in double digits, despite the Chinese New Year starting on January 28. During the holiday period (Jan 28 – Feb 4), 900,000+ border crossings were recorded at the Hong Kong-Zhuhai-Macau Bridge, a historic high. However, despite the double-digit growth in visitor traffic, watch sales remained weak, further hurting confidence in the sector’s outlook.

Missing the luxury train

Swatch is banking on new opportunities for mid-range brands like Tissot, Longines and Hamilton.

However, watches priced at CHF 200-500 have suffered most (see the chart below), largely due to competition from Apple Watch, which launched its first-generation model in April 2015. We see this downturn as structural, not cyclical.

Maintained demand for smartwatches continues to erode market share in this segment. Swatch has attempted to leverage its expertise in low-power, long-battery-life technology with the Tissot Smartwatch (2018) but has struggled to compete with the advanced wearables from Apple and Google.

A softer consumer environment (downtrading) won’t reverse the digital revolution Apple brought to the industry 10 years ago. We do not see much growth potential for mid-range watches moving forward.

Overshadowed Omega

We continue to believe that Swatch has missed a critical opportunity to leverage and amplify Omega’s exclusive brand power. Omega stands among the world’s most prestigious watch brands, alongside Rolex and Patek Philippe.

In October 2021, Partners Group Holding acquired a 25% stake in Breitling from CVC Capital Partners, valuing the brand at €2.9bn (5.8x its 2020 revenue). While these multiples need to be adjusted for today’s weaker market environment, Omega—accounting for close to 25% of Swatch’s sales (c.€1.5bn)—still holds substantial value. Even after a 30% discount to the Breitling multiple, Omega + Swatch's net cash position (CHF 1.1bn) could be valued at c.CHF7bn, not that far from Swatch's spot market cap.

Oddly Swatch has opted to prioritise investment in mid-range watch brands, leading to Omega’s losing ground to the industry peers.

The Hayek negative

We slashed our earnings expectations following the disappointing H2 24 results and have adopted a more cautious stance on the stock. Our fundamental metrics indicate considerable downside potential.

A material inflexion point in the top-line momentum is sorely required. Sticking to Swiss-made production—even for lower-end products—is pressuring margins further. As a result, a profitability rebound is likely to take longer than expected.

In addition, the Hayek family with 25% of the capital and 43% of the voting rights remains at odds with the markets/minority shareholders.

CEO Nick Hayek has publicly expressed no intention of strengthening engagement with sell-side analysts and investors, nor does he plan to reinstate an Investor Relations department. He has repeatedly stated that “if investors dislike the company’s management or governance, they are free to invest elsewhere.” There is a conundrum in mentioning that a delisting would be a "nice thing to do" but that the family is unwilling to take on the debt required for a buyout.

For AlphaValue, Swatch is a confirmation that family control is not always a win-win for minority shareholders. AlphaValue initiated coverage 15 years ago when Swatch was worth CHF100. Not much progress has been achieved since. The following chart, which tracks the fundamental strength of corporates, show how destructive the Hayek management has been over the last 12 years in an industry that has basked in growth.

Swatch fundamental strength (/10, in pink) vs. Luxury (blue)

If only the firm were to focus on its upscale brands, it would send the right growth message.

Subscribe to our blog

As contrarian born market participants, what would we buy into this quality universe with closed eye?

This is a testament to the new speculative pull of a putative Ukraine reconstruction, while not ever...