Sampo's dividend dancing with Nordea?

[dropcap]L[/dropcap]ast week, Saxo Bank, in which Sampo took a 19.9% stake for €265m in 2017, appointed a new Head of Operations, Oliver ZECEVIC.

The new manager had spent his entire 16-year career in Nordea, where he was the Head of Investor Solutions & Services.

The information in itself is not important but it does confirm the close connections between Nordea 21%-owned by Sampo and Sampo. As a reminder, the Nordea stake accounts for c. 30% of Sampo’s gross assets.

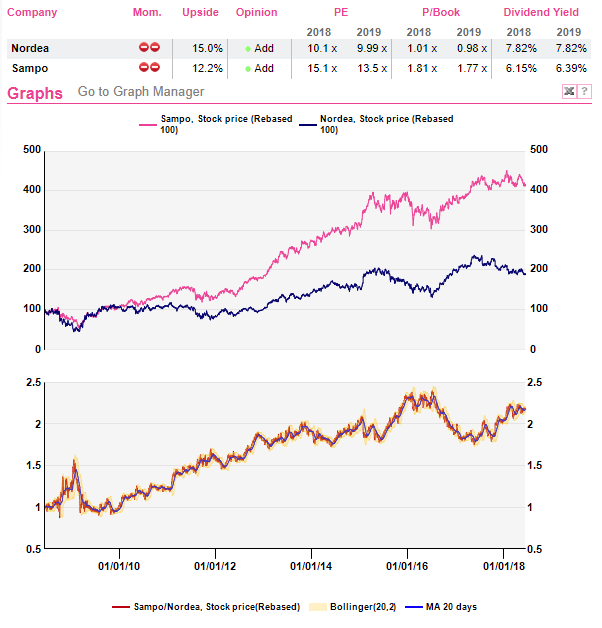

As it happens, owing to Nordea’s idiosyncrasies as befits a bank, the two shares are following rather diverging trajectories. A 10-year chart is telling: the money was on the insurer. Whether it would have done even better without tying up resources in Nordea is very hard to tell as the two firms are confident partners on the ground.

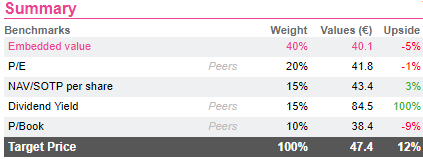

Buying into Sampo means buying into solid non-life insurance (not discussed here) and a dividend income from Nordea. We see a 12% upside worth going for in the current bout of weakness for Financials.

Sampo is a long distance runner

Crossing management

Speaking of governance, Sampo and Nordea are a unique example in the AV universe. Both share the same Chairman, Björn WAHLROOS. Three other directors of Sampo worked previously in the bank: Eira PALIN-LEHTINEN (1998-2007), Christian CLAUSEN (2000-16) and even the new board member, Antti MÄKINEN was a Director in Nordea during 2010-17.

Therefore, 50% of its board members has graduated from the “Nordea school”. On the executive front, Sampo’s CEO, Kari STADIGH, has been a board member of Nordea since 2010 and the Chairman of its Risk Committee. Another senior staff, Torbjörn MAGNUSSON, is also a board member of the Bank.

This governance imbrication weaves a complex picture whereby Nordea seems to be controlling Sampo, but where Sampo is the largest shareholder of Nordea.

“Hidden” agenda?

Nordea is the biggest Nordic financial institution facing, like its peers, the challenge of meeting new technologies and changing regulations. Its recent plans to change its headquarters to … Finland is a good measure of such challenges.

Sampo has a major role in supporting the bank, serving as a temporary business incubator. In fact, the insurer invested in three companies in 2017-18, after long quiet years, for a total of €750m.

With Nordic Capital, the insurer took over Nordax, a Swedish online bank offering consumer credit. It has invested in Saxo Bank, a fintech-type bank company specialised in online trading as well as in Nets, a leading payments services provider in the Nordic countries and a pioneer in digital payments.

Nordea controlled 20.7% of the capital of this company but sold its stake in 2014 for €470m. The bank has currently a service agreement with Nets, where it will support Nordea’s digital transformation efforts by delivering digital signing, identification and document distribution services in all the Nordic countries.

These Sampo acquisitions are clearly rather bank-geared and may be at a distance from non-life insurance. It is worth pointing out that Sampo is in no need of productivity tools/exotic business models as it has no problem in terms of cost control. In Q1 18, the combined ratio was 86.5%, while the target is to remain below 95%. Its expense ratio is also weak, at 16.2%.

The acceleration of corporate activity at Sampo coincides with the digital transformation plan of Nordea, which will reshape its group organisation by 2022. The bank will, over the next four years, lay-off 4,000 staff and 2,000 consultants. During this period of downsizing, it may use Sampo as a hatching box to prepare its shift to a full-fledged digital bank.

These Sampo acquisitions will not bring anything in terms of dividends, a vital criterion for the insurer, and it is difficult to consider them as strategic, so that they may indeed end up at Nordea later on.

A dividend story

Why should Sampo tie-up good cash while it is suffering in terms of investment yield? In its P&C branch, the Q1 18 mark-to-market investment return was -0.1%. The answer can only be that Nordea’s contribution to the insurer’s profit amounts to a quarter of pre-tax earnings.

It has been a generous dividend payer with €2,306m transferred to the insurer over the last five years. That may not last forever as we have doubts about the fact that Nordea’s 70% pay-out ratio is sustainable.

Nordea’s dividend amounts to nearly 40% of Sampo’s own pay-out. That cannot really be left to erode markedly.

As it happens Sampo is fully valued on AlphaValue's metrics except for its yield which reflects an 80% pay-out policy.

Crossing management

Speaking of governance, Sampo and Nordea are a unique example in the AV universe. Both share the same Chairman, Björn WAHLROOS. Three other directors of Sampo worked previously in the bank: Eira PALIN-LEHTINEN (1998-2007), Christian CLAUSEN (2000-16) and even the new board member, Antti MÄKINEN was a Director in Nordea during 2010-17.

Therefore, 50% of its board members has graduated from the “Nordea school”. On the executive front, Sampo’s CEO, Kari STADIGH, has been a board member of Nordea since 2010 and the Chairman of its Risk Committee. Another senior staff, Torbjörn MAGNUSSON, is also a board member of the Bank.

This governance imbrication weaves a complex picture whereby Nordea seems to be controlling Sampo, but where Sampo is the largest shareholder of Nordea.

“Hidden” agenda?

Nordea is the biggest Nordic financial institution facing, like its peers, the challenge of meeting new technologies and changing regulations. Its recent plans to change its headquarters to … Finland is a good measure of such challenges.

Sampo has a major role in supporting the bank, serving as a temporary business incubator. In fact, the insurer invested in three companies in 2017-18, after long quiet years, for a total of €750m.

With Nordic Capital, the insurer took over Nordax, a Swedish online bank offering consumer credit. It has invested in Saxo Bank, a fintech-type bank company specialised in online trading as well as in Nets, a leading payments services provider in the Nordic countries and a pioneer in digital payments.

Nordea controlled 20.7% of the capital of this company but sold its stake in 2014 for €470m. The bank has currently a service agreement with Nets, where it will support Nordea’s digital transformation efforts by delivering digital signing, identification and document distribution services in all the Nordic countries.

These Sampo acquisitions are clearly rather bank-geared and may be at a distance from non-life insurance. It is worth pointing out that Sampo is in no need of productivity tools/exotic business models as it has no problem in terms of cost control. In Q1 18, the combined ratio was 86.5%, while the target is to remain below 95%. Its expense ratio is also weak, at 16.2%.

The acceleration of corporate activity at Sampo coincides with the digital transformation plan of Nordea, which will reshape its group organisation by 2022. The bank will, over the next four years, lay-off 4,000 staff and 2,000 consultants. During this period of downsizing, it may use Sampo as a hatching box to prepare its shift to a full-fledged digital bank.

These Sampo acquisitions will not bring anything in terms of dividends, a vital criterion for the insurer, and it is difficult to consider them as strategic, so that they may indeed end up at Nordea later on.

A dividend story

Why should Sampo tie-up good cash while it is suffering in terms of investment yield? In its P&C branch, the Q1 18 mark-to-market investment return was -0.1%. The answer can only be that Nordea’s contribution to the insurer’s profit amounts to a quarter of pre-tax earnings.

It has been a generous dividend payer with €2,306m transferred to the insurer over the last five years. That may not last forever as we have doubts about the fact that Nordea’s 70% pay-out ratio is sustainable.

Nordea’s dividend amounts to nearly 40% of Sampo’s own pay-out. That cannot really be left to erode markedly.

As it happens Sampo is fully valued on AlphaValue's metrics except for its yield which reflects an 80% pay-out policy.

Subscribe to our blog

AlphaValue has certainly not been alone over the last 4 months in wondering when too much was to...

A week ago, Reckitt posted splendid Q3 sales lifted by emerging markets demand, while L’Oré...