Real Life Debt Is Bound To Cost More

A combination of Central Banks dropping their guards, easy capital for AI stamped businesses and Trump-related bullishness will see markets assume that money is there to be made whatever the asset class.

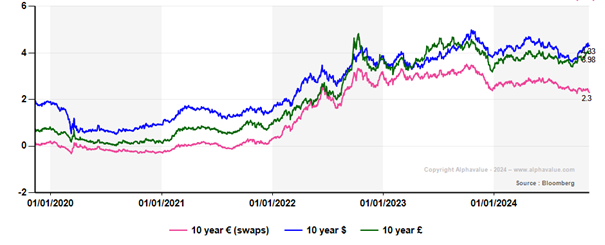

For investors still unimpressed by the Trump spell, it will pay to remember that, since interest rate rises started in early 2022, $ 10y rates have still moved 280bp higher to 4.3%, the UK variant has increased by 300bp to 4% and 10y Euro swaps have moved up ‘only’ 200bp to 2.35% presumably thanks to Germany being semi comatose. It takes a Swiss refinancing to experience a 10y funding cost up by only 70bp over the same period.

Long financing remains expensive

The point here is that European corporates are likely to have experienced a sharp increase in their financial costs but their bottom lines seem indifferent. The following table makes the point, computed on the AlphaValue coverage (ex Financials and ex Deep Cyclicals as these are driven by external contingencies). The inferences are quite remarkable.

Higher rates have not fed through to interest bills

Effectively the transmission of higher risk-free rates has yet to happen to the universe under review (€10Tn market cap) as corporate spreads of 3.4% in 2021 and 3.9% in 2019 (two ‘normal’ years) have compressed to c.2% since 2022.

If one assumes that the debt markets are the driving party (which we believe) another 100bp to 150bp widening in the spread is bound to become visible in 2025-2026 assuming an average 5-year roll. +100bps is worth c. €15bn in post-tax earnings or 2.7% erosion. We computed this impact on 2023 total debt as the 2025 forecast is presumably too optimistic if spreads widen.

As discussed in NIRP/ZIRP years in those AlphaValue short papers, it is an open discussion whether corporate spreads widen, in a zero to negative risk-free rates context, as a way to offset deflation risks on the repayment of principal. By construction in a normal yield curve context, business is expected to be brisk and thus spreads may not need to be as wide as risks fall. This is only correct if companies do not face a late cycle (AlphaValue opinion) or an outright recession in which case lenders would want wider spreads to cover rising delinquencies. It is also a fact that borrowing by smaller companies is vastly more expensive than for the bulk of the AlphaValue coverage (large European caps mostly).

In all it is fairly likely that the P&Ls of larger European corporates have yet to experience the full costs of the 2022 rate rises.

For investors still unimpressed by the Trump spell, it will pay to remember that, since interest rate rises started in early 2022, $ 10y rates have still moved 280bp higher to 4.3%, the UK variant has increased by 300bp to 4% and 10y Euro swaps have moved up ‘only’ 200bp to 2.35% presumably thanks to Germany being semi comatose. It takes a Swiss refinancing to experience a 10y funding cost up by only 70bp over the same period.

Long financing remains expensive

The point here is that European corporates are likely to have experienced a sharp increase in their financial costs but their bottom lines seem indifferent. The following table makes the point, computed on the AlphaValue coverage (ex Financials and ex Deep Cyclicals as these are driven by external contingencies). The inferences are quite remarkable.

Higher rates have not fed through to interest bills

Effectively the transmission of higher risk-free rates has yet to happen to the universe under review (€10Tn market cap) as corporate spreads of 3.4% in 2021 and 3.9% in 2019 (two ‘normal’ years) have compressed to c.2% since 2022.

If one assumes that the debt markets are the driving party (which we believe) another 100bp to 150bp widening in the spread is bound to become visible in 2025-2026 assuming an average 5-year roll. +100bps is worth c. €15bn in post-tax earnings or 2.7% erosion. We computed this impact on 2023 total debt as the 2025 forecast is presumably too optimistic if spreads widen.

As discussed in NIRP/ZIRP years in those AlphaValue short papers, it is an open discussion whether corporate spreads widen, in a zero to negative risk-free rates context, as a way to offset deflation risks on the repayment of principal. By construction in a normal yield curve context, business is expected to be brisk and thus spreads may not need to be as wide as risks fall. This is only correct if companies do not face a late cycle (AlphaValue opinion) or an outright recession in which case lenders would want wider spreads to cover rising delinquencies. It is also a fact that borrowing by smaller companies is vastly more expensive than for the bulk of the AlphaValue coverage (large European caps mostly).

In all it is fairly likely that the P&Ls of larger European corporates have yet to experience the full costs of the 2022 rate rises.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.