Peace Dividends, Sort Of

This is a most extraordinary development. The Ukraine war may be reaching an end (dixit Donald) but Defence stocks have been catapulted to new highs. From a shareholder standpoint, the concept of a peace dividend is taking a fresh twist: it is about more spending on defence kit.

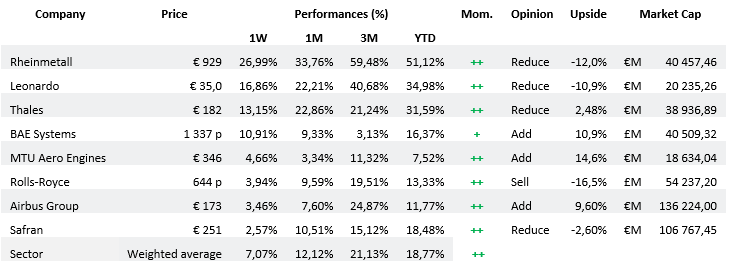

The following table shows the incredible performance of Rheinmetall, the current investor darling for anything Defence. The sector has gained 19% ytd (18-02 close). Saab (not covered) has booked a 22% gain. On the fundamentals the sector offers no upside pending the inevitable earnings upgrades following that ‘peace dividend’. To quote but two 2024 earnings releases of the day (19-02), BAE and MTU have already posted significant ‘beats’.

AlphaValue has been left somewhat stunned by the magnitude of this positive reaction. Well before Trump took the US helm it had been clear that Europe would have to spend massively more on defence. As early at late 2022, even AlphaValue suggested that a "3% of GDP" effort was a likely to be the bare minimum to contain the Russian and other risks. So this extra business for the defence sector should not be new news.

Nobody is inclined to believe that Europe will spend as much as 5% of its GDP on defence. That really would reflect a new paradigm - i.e. the development of a political crisis of massive proportion - by which time the markets may have other pressing concerns.

The latest Trump/Vance/Rubio comments whereby Europe may no longer bask under the US defence umbrella might be regarded as the trigger toward this new paradigm by some investors. It does however sound as if Europe is far from ready/is not afraid enough to spend substantially more than its current 2% or so of GDP.

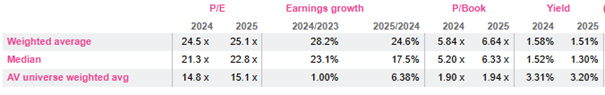

For now the Aerospace & Defence sector trades at a remarkable 25x 2025 earnings. That is LVMH-style valuation territory and presumably dear unless one thinks that the +25% 2025 earnings growth will stick around for the next 10 years. That may be a hard call as the listed sector essentially remains in its 20th century format i.e. catering for big contracts for big platforms and difficult margins on late delivery.

Defence sector valuation essentials

As we have mentioned in earlier similar short papers, the future of listed defence procurement lies more with digital and systems providers than with manned heavy equipment. US Anduril or German Helsing will make the music, presumably less so Thales which, like its peers, will remain encumbered by its legacy business. Ukraine defence start-ups are likely to be way ahead of the Western pack and it seems that Russian developers are no slouch either as they find ways to turn the best washing machine CPUs into drones or missiles.

In other words, today’s investors are banking on the fact that the listed European players are bound to play a big role and consolidate new entrants. Let us see how the new ‘AI’ entrants fare.

The following table shows the incredible performance of Rheinmetall, the current investor darling for anything Defence. The sector has gained 19% ytd (18-02 close). Saab (not covered) has booked a 22% gain. On the fundamentals the sector offers no upside pending the inevitable earnings upgrades following that ‘peace dividend’. To quote but two 2024 earnings releases of the day (19-02), BAE and MTU have already posted significant ‘beats’.

AlphaValue has been left somewhat stunned by the magnitude of this positive reaction. Well before Trump took the US helm it had been clear that Europe would have to spend massively more on defence. As early at late 2022, even AlphaValue suggested that a "3% of GDP" effort was a likely to be the bare minimum to contain the Russian and other risks. So this extra business for the defence sector should not be new news.

Nobody is inclined to believe that Europe will spend as much as 5% of its GDP on defence. That really would reflect a new paradigm - i.e. the development of a political crisis of massive proportion - by which time the markets may have other pressing concerns.

The latest Trump/Vance/Rubio comments whereby Europe may no longer bask under the US defence umbrella might be regarded as the trigger toward this new paradigm by some investors. It does however sound as if Europe is far from ready/is not afraid enough to spend substantially more than its current 2% or so of GDP.

For now the Aerospace & Defence sector trades at a remarkable 25x 2025 earnings. That is LVMH-style valuation territory and presumably dear unless one thinks that the +25% 2025 earnings growth will stick around for the next 10 years. That may be a hard call as the listed sector essentially remains in its 20th century format i.e. catering for big contracts for big platforms and difficult margins on late delivery.

Defence sector valuation essentials

As we have mentioned in earlier similar short papers, the future of listed defence procurement lies more with digital and systems providers than with manned heavy equipment. US Anduril or German Helsing will make the music, presumably less so Thales which, like its peers, will remain encumbered by its legacy business. Ukraine defence start-ups are likely to be way ahead of the Western pack and it seems that Russian developers are no slouch either as they find ways to turn the best washing machine CPUs into drones or missiles.

In other words, today’s investors are banking on the fact that the listed European players are bound to play a big role and consolidate new entrants. Let us see how the new ‘AI’ entrants fare.

Subscribe to our blog

As contrarian born market participants, what would we buy into this quality universe with closed eye?

This is a testament to the new speculative pull of a putative Ukraine reconstruction, while not ever...