OPAP's Cash Printing Talent Has No Brake

OPAP is a very attractive asset in the gaming-gambling industry, with the combination of a highly-cash-generative business and good capital allocation translating into best-in-class return metrics.

The last time we pushed the story was in the summer of 2023. Back then, our optimism was buoyed by the strong recovery in the Greek travel industry and OPAP’s online progression.

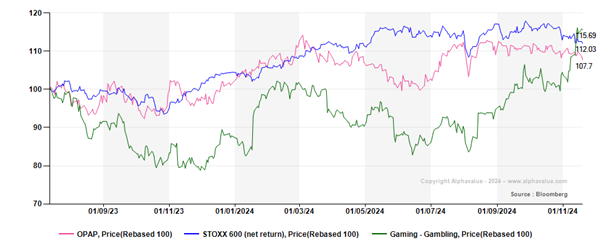

The 7.7% uptick since then (vs 15.7%/12% rise in the AV gaming-gambling sector/Stoxx 600, respectively) does little justice to the continued operational progress. In effect, we see reasons to buy in, even though the stock continues to flirt with its all-time highs. Its Q3 earnings released today with an Ebitda up by 24% speak for themselves and confirm the solidity of the investment case.

OPAP has consistently reinvented itself over time.

Although OPAP had historically been known as a steady dividend play, it is worth noting that the firm has consistently adapted, irrespective of the challenges thrown at it. The addition of VLTS (in 2017) and the recent focus on online vertical (since 2019) have not only broadened the product offering but have also helped diversify the revenue base across channels. In hindsight, the continuous but consistent transformation has been well thought out, resulting in steady growth over time (5.5% CAGR since 2015).

Fading travel boom

As we have said in the past, the rebound of the global travel sector has been stronger than expected. After posting a record 2023, the Greek travel industry is set to hit another all-time high in 2024. With tourism accounting for nearly a fifth of Greek GDP as well as employment, it is a key driver of discretionary purchasing like betting and casino spends (account for ~60% of OPAP's revenues).

However, the continued macro uncertainty (still-high inflation) and even fears of crowds of tourists have started to weigh on tourist spending (up by only low-single digits vs high single-digit growth in tourist arrivals) and could pose a near-term risk to this market recovery.

Online optionality underpinned by retail barriers to entry

Despite the easing tourism tailwinds, OPAP has delivered steady operational progress over the last year (average growth of 7.4%). This has largely been driven by the online channel (+22%), which has benefitted from market share gains in competitive sub-markets (online sports betting and casino mainly, market growing at high-single digits).

However, it’s worth noting that the value of the enterprise is still rooted in the stability provided by the firm’s ‘cash cow’ - retail gambling (~72% revenue contribution), which is protected by monopolistic/exclusive rights through to the end of this decade. These high barriers to entry are further complemented by an asset-light franchise distribution model.

Looking at the bigger picture, we note that the per capita gambling spend in Greece (93% of revenue) and Cyprus (7% of revenue) is over 40%/30% lower, respectively, than the highest spending countries in Europe. Effectively, OPAP has a long runway of growth available within its current geographical footprint.

In effect, we expect the mid-to-long term growth to stem from the increasing penetration of gambling, product innovations/optimizations in the retail channel and the strong uptake of online gambling.

Looking beyond the geographical constraints

However, given the strong balance sheet (detailed below), can this domestic success be leveraged to expand the geographical footprint? Following the recent successful bid by French peer FDJ for Kindred, a pan-European online gambling operator, it is worth speculating whether OPAP could take a similar punt. With no shortage of targets (888, Entain recently looking to offload brands), can OPAP take a leaf out of the book of its parent Allwyn, which took over the UK National lottery operations earlier this year? While this is pure conjecture at this point, the strategic and financial fit of such a deal could be hard to argue against.

Financials as solid as ever

Thanks to the benefits within the addendum agreement (an extension to the original licensing agreement, see our teaser dated 13 July 2023 for details), OPAP posts industry-leading profit margins (EBITDA margin ~15pp higher than the AV sector peers). These solid margins will be further supported by OPAP’s good cost discipline and scale benefits from the rapidly-growing online business. This underpins our thesis of incremental improvements in the already-impressive ROCE metrics (45.8% FY26e vs 44% in 2023).

Furthermore, with FCF conversion of >80% and best-in-class leverage metrics (FY24 net debt/EBITDA 0.7x vs 2.1x for AV sector peers), OPAP sports a rock-solid financial profile. Hence, it should easily be able to cover the limited investment needs of its asset-light operations as well as a generous dividend (minimum annual commitment of €1/share). This provides comfort in a sector that is known for its frenzy of consolidation.

Still undemanding valuations. Poised for a re-rating?

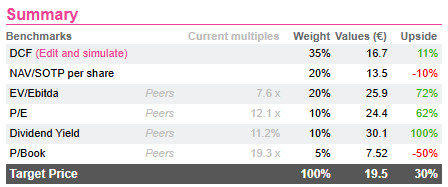

Post the phenomenal run over the last three years (+59%, largely captured as a part of the AlphaValue Active portfolio), the stock is trading at all-time highs. While this has eaten into the upside in our intrinsic valuations, the stock continues to trade at very attractive levels.

At 12.4x FY24e EPS, OPAP not only trades at the lower end of its 5Y valuation range (9.9x – 23.4x) but is also priced at a steep 45% discount to the AV peers. Essentially its share price performance has been earnings driven. With the firm clearly advancing in the key strategic growth areas, we believe a re-rating is warranted.

Any long-term investor looking for exposure to gaming-gambling, but willing to weather some minor near-term macro risks, should get on board. The wait is made worthwhile by a mouth-watering FY24e dividend yield of 10.8%, underpinned by the firm’s commitment to distributing at least €1/share as the annual dividend.

The last time we pushed the story was in the summer of 2023. Back then, our optimism was buoyed by the strong recovery in the Greek travel industry and OPAP’s online progression.

The 7.7% uptick since then (vs 15.7%/12% rise in the AV gaming-gambling sector/Stoxx 600, respectively) does little justice to the continued operational progress. In effect, we see reasons to buy in, even though the stock continues to flirt with its all-time highs. Its Q3 earnings released today with an Ebitda up by 24% speak for themselves and confirm the solidity of the investment case.

OPAP has consistently reinvented itself over time.

Although OPAP had historically been known as a steady dividend play, it is worth noting that the firm has consistently adapted, irrespective of the challenges thrown at it. The addition of VLTS (in 2017) and the recent focus on online vertical (since 2019) have not only broadened the product offering but have also helped diversify the revenue base across channels. In hindsight, the continuous but consistent transformation has been well thought out, resulting in steady growth over time (5.5% CAGR since 2015).

Fading travel boom

As we have said in the past, the rebound of the global travel sector has been stronger than expected. After posting a record 2023, the Greek travel industry is set to hit another all-time high in 2024. With tourism accounting for nearly a fifth of Greek GDP as well as employment, it is a key driver of discretionary purchasing like betting and casino spends (account for ~60% of OPAP's revenues).

However, the continued macro uncertainty (still-high inflation) and even fears of crowds of tourists have started to weigh on tourist spending (up by only low-single digits vs high single-digit growth in tourist arrivals) and could pose a near-term risk to this market recovery.

Online optionality underpinned by retail barriers to entry

Despite the easing tourism tailwinds, OPAP has delivered steady operational progress over the last year (average growth of 7.4%). This has largely been driven by the online channel (+22%), which has benefitted from market share gains in competitive sub-markets (online sports betting and casino mainly, market growing at high-single digits).

However, it’s worth noting that the value of the enterprise is still rooted in the stability provided by the firm’s ‘cash cow’ - retail gambling (~72% revenue contribution), which is protected by monopolistic/exclusive rights through to the end of this decade. These high barriers to entry are further complemented by an asset-light franchise distribution model.

Looking at the bigger picture, we note that the per capita gambling spend in Greece (93% of revenue) and Cyprus (7% of revenue) is over 40%/30% lower, respectively, than the highest spending countries in Europe. Effectively, OPAP has a long runway of growth available within its current geographical footprint.

In effect, we expect the mid-to-long term growth to stem from the increasing penetration of gambling, product innovations/optimizations in the retail channel and the strong uptake of online gambling.

Looking beyond the geographical constraints

However, given the strong balance sheet (detailed below), can this domestic success be leveraged to expand the geographical footprint? Following the recent successful bid by French peer FDJ for Kindred, a pan-European online gambling operator, it is worth speculating whether OPAP could take a similar punt. With no shortage of targets (888, Entain recently looking to offload brands), can OPAP take a leaf out of the book of its parent Allwyn, which took over the UK National lottery operations earlier this year? While this is pure conjecture at this point, the strategic and financial fit of such a deal could be hard to argue against.

Financials as solid as ever

Thanks to the benefits within the addendum agreement (an extension to the original licensing agreement, see our teaser dated 13 July 2023 for details), OPAP posts industry-leading profit margins (EBITDA margin ~15pp higher than the AV sector peers). These solid margins will be further supported by OPAP’s good cost discipline and scale benefits from the rapidly-growing online business. This underpins our thesis of incremental improvements in the already-impressive ROCE metrics (45.8% FY26e vs 44% in 2023).

Furthermore, with FCF conversion of >80% and best-in-class leverage metrics (FY24 net debt/EBITDA 0.7x vs 2.1x for AV sector peers), OPAP sports a rock-solid financial profile. Hence, it should easily be able to cover the limited investment needs of its asset-light operations as well as a generous dividend (minimum annual commitment of €1/share). This provides comfort in a sector that is known for its frenzy of consolidation.

Still undemanding valuations. Poised for a re-rating?

Post the phenomenal run over the last three years (+59%, largely captured as a part of the AlphaValue Active portfolio), the stock is trading at all-time highs. While this has eaten into the upside in our intrinsic valuations, the stock continues to trade at very attractive levels.

At 12.4x FY24e EPS, OPAP not only trades at the lower end of its 5Y valuation range (9.9x – 23.4x) but is also priced at a steep 45% discount to the AV peers. Essentially its share price performance has been earnings driven. With the firm clearly advancing in the key strategic growth areas, we believe a re-rating is warranted.

Any long-term investor looking for exposure to gaming-gambling, but willing to weather some minor near-term macro risks, should get on board. The wait is made worthwhile by a mouth-watering FY24e dividend yield of 10.8%, underpinned by the firm’s commitment to distributing at least €1/share as the annual dividend.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.