Novo Nordisk Down, Not Out

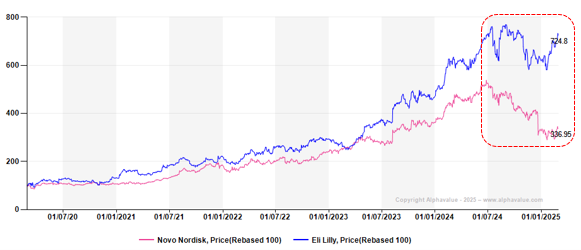

Weight-loss drugs – just like artificial intelligence, electric vehicles and decarbonisation – have been a megatrend this decade. It all began with the 2021 US FDA approval of Novo Nordisk’s (Buy; Denmark) Wegovy. While Novo and Eli Lilly (Zepbound) have been handsomely rewarded as frontrunners in recent years, in the last few months investors have started to doubt the market potential, touted to reach $100bn by 2030 (vs. around $20bn in 2024).

Recent market scepticism

Concerns underlying the pain …

The massive market cap contraction (i.e. $240bn or >35%) since June 2024, is unprecedented in Novo’s (the diabetes and obesity treatment leader) history. Multiple factors have been at play, including the apprehension around the obesity market's potential, future competition threats from the likes of Roche and others, and imminent price declines for its key diabetes/obesity drugs starting from 2027 because of the US Inflation Reduction Act (IRA). However, the heaviest blow came in December 2024, when Novo’s new candidate, CagriSema, demonstrated 22.7% weight-loss over 68 weeks in phase III trials, falling somewhat short of the anticipated 25%.

… which, nonetheless, seem overblown

With the latest generation of weight-loss drugs (i.e. Wegovy and Zepbound) helping obese/overweight individuals lose c.15-20% of their body weight (comparable to bariatric surgery and much more efficacious than older anti-obesity drugs, which resulted in only 5-10% weight loss), there has been a rush for these medicines, which could cater to nearly 1bn obese individuals worldwide – a number expected to double by 2035, as per the World Obesity Federation. Hence, it would have been naïve to not consider future competitive threats and the resultant pricing pressure. With regards to US IRA, Novo had warned well in advance about the possibility of its drugs being subject to lower prices starting 2027. Coming to CagriSema, even its current efficacy levels place it amongst the best-available weight-loss options, and Novo should start another trial this year to hopefully show better efficacy from CagriSema, demonstrating confidence in its potential.

Addressing the bigger question of market size: For the obesity market to reach $100bn, around 20-30m people (which is 18%-27% of just the US’ 110m obese population, let alone other countries) need to consume these drugs, assuming an average monthly price of just $300-400 (baking in the pricing pressure) vs. Wegovy’s US list price of c.$1,350/monthly dosing. This does not seem like an unfathomable scenario. While one may argue that (on average) only one-third of patients remain on Wegovy after 12 months (because of side-effects, the weight-loss goals being met, and/or fatigue, amongst other reasons), many may return to the treatment considering the potential weight gain after discontinuation. To fully realise the weight-loss drugs’ potential, efforts are under way to also develop solutions for preserving muscle mass, the loss of which is one of the key side-effects of the latest anti-obesity medications.

Consider another area of scepticism. With c.60% of the US diabetic population (c.35m) being obese, questions arise if the new weight-loss drugs (most of them targeting the GLP-1 hormone), initially developed to treat diabetes, can cannibalise the diabetes market. The answer is no, since the GLP-1 drugs still account for only c.7% of total diabetes prescriptions, indicating the huge scope for market penetration. Moreover, of the 537m diabetic people globally, only around half of them are diagnosed and just c.15% are in good control, highlighting a substantial unmet need. Having said that, some impact on the pharmas’ diabetes-related cash flows can’t be ruled out in the distant future.

Expect the strength to continue in the foreseeable future

Besides Wegovy (c.20% of 2024 sales; +86% CER), Novo’s diabetes offerings Ozempic (c.41%; +26%) and Rybelsus (c.8%; +26%) have also been growing at a commendable pace, which is likely to be sustained well into the medium/longer term, backed by their market dominance and the huge scope for penetration as an increasing number of people transition towards GLP-1s (on account of their better sugar-control and additional benefits) from older medicines.

The galloping demand for weight-loss drugs has led to a persistent shortage of Wegovy since its market introduction. Consequently, both Novo and Lilly have been investing heavily in expanding their production capacity, with Novo announcing >DKK130bn (c.$18bn) of capacity investment as of 2021. The $11bn acquisition of Catalent’s three manufacturing sites should start bearing fruit from 2026 onwards. Larger capacity should also reduce the competition from US’ compounding pharmacies, which are allowed to make copy-cat versions whenever a drug is in short supply. Moreover, demand should receive a boost in the event that anti-obesity medicines receive US governmental insurance coverage under Medicare and Medicaid (US health insurance programmes for the elderly, and low-income families, respectively) for just their weight-loss benefit (currently, these medicines are covered for obese people with a co-morbidity) – as proposed by the previous Biden government. This development could provide access to the latest anti-obesity medications for 7.4m people under Medicare and Medicaid, which should easily take the sting out of lower prices for Ozempic/Wegovy starting 2027. Note that Novo’s obesity offerings may also find applications in reducing the risk of cardiovascular events, kidney disease, sleep apnoea, alcohol addiction and/or even Alzheimer’s.

While Novo has CagriSema, Amycretin (a once-weekly subcutaneous injection; highest dose produced c.22% weight-loss in an early-stage trial) and a few others to extend its lead in this and even the diabetes market, there are also promising pipeline drug candidates from Eli Lilly, Amgen, Boehringer Ingelheim, Zealand Pharma and others, that could challenge the incumbents. Therefore, we see obesity eventually becoming a multi-player game. For details, refer to our report ‘Pick Your Weight-Loss Molecule’ from December 2024. With the efficacy bar already set high, newer drugs could differentiate themselves through fewer side-effects, dosing frequency and administration convenience (e.g. oral options).

Considering everything, after a 27% top-line CAGR over 2021-24, we expect Novo to sustain the momentum with c.18% and c.16% top-line and bottom-line CAGR, respectively, over the next three years.

Price-levels too good to pass up

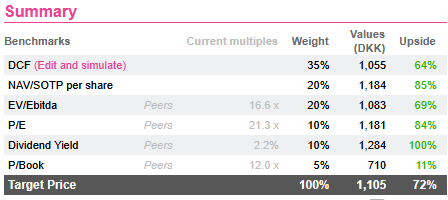

Despite the enviable growth prospects, Novo’s shares currently trade at 2025e and 2026e P/Es of c.22x and c.18x, respectively – levels unseen since the Wegovy launch. Our strong upside on Novo is backed by the fundamental and relative valuation parameters. With the FDA declaring the end of the shortage for Ozempic/Wegovy, the shares have perhaps turned a corner. A few more catalysts could provide sales/earnings beats in the coming quarters, and/or any favourable move from the Trump government regarding the anti-obesity drugs’ governmental insurance coverage. In summary, an against-the-wind bet on this high-quality name should pay off handsomely.

Recent market scepticism

Concerns underlying the pain …

The massive market cap contraction (i.e. $240bn or >35%) since June 2024, is unprecedented in Novo’s (the diabetes and obesity treatment leader) history. Multiple factors have been at play, including the apprehension around the obesity market's potential, future competition threats from the likes of Roche and others, and imminent price declines for its key diabetes/obesity drugs starting from 2027 because of the US Inflation Reduction Act (IRA). However, the heaviest blow came in December 2024, when Novo’s new candidate, CagriSema, demonstrated 22.7% weight-loss over 68 weeks in phase III trials, falling somewhat short of the anticipated 25%.

… which, nonetheless, seem overblown

With the latest generation of weight-loss drugs (i.e. Wegovy and Zepbound) helping obese/overweight individuals lose c.15-20% of their body weight (comparable to bariatric surgery and much more efficacious than older anti-obesity drugs, which resulted in only 5-10% weight loss), there has been a rush for these medicines, which could cater to nearly 1bn obese individuals worldwide – a number expected to double by 2035, as per the World Obesity Federation. Hence, it would have been naïve to not consider future competitive threats and the resultant pricing pressure. With regards to US IRA, Novo had warned well in advance about the possibility of its drugs being subject to lower prices starting 2027. Coming to CagriSema, even its current efficacy levels place it amongst the best-available weight-loss options, and Novo should start another trial this year to hopefully show better efficacy from CagriSema, demonstrating confidence in its potential.

Addressing the bigger question of market size: For the obesity market to reach $100bn, around 20-30m people (which is 18%-27% of just the US’ 110m obese population, let alone other countries) need to consume these drugs, assuming an average monthly price of just $300-400 (baking in the pricing pressure) vs. Wegovy’s US list price of c.$1,350/monthly dosing. This does not seem like an unfathomable scenario. While one may argue that (on average) only one-third of patients remain on Wegovy after 12 months (because of side-effects, the weight-loss goals being met, and/or fatigue, amongst other reasons), many may return to the treatment considering the potential weight gain after discontinuation. To fully realise the weight-loss drugs’ potential, efforts are under way to also develop solutions for preserving muscle mass, the loss of which is one of the key side-effects of the latest anti-obesity medications.

Consider another area of scepticism. With c.60% of the US diabetic population (c.35m) being obese, questions arise if the new weight-loss drugs (most of them targeting the GLP-1 hormone), initially developed to treat diabetes, can cannibalise the diabetes market. The answer is no, since the GLP-1 drugs still account for only c.7% of total diabetes prescriptions, indicating the huge scope for market penetration. Moreover, of the 537m diabetic people globally, only around half of them are diagnosed and just c.15% are in good control, highlighting a substantial unmet need. Having said that, some impact on the pharmas’ diabetes-related cash flows can’t be ruled out in the distant future.

Expect the strength to continue in the foreseeable future

Besides Wegovy (c.20% of 2024 sales; +86% CER), Novo’s diabetes offerings Ozempic (c.41%; +26%) and Rybelsus (c.8%; +26%) have also been growing at a commendable pace, which is likely to be sustained well into the medium/longer term, backed by their market dominance and the huge scope for penetration as an increasing number of people transition towards GLP-1s (on account of their better sugar-control and additional benefits) from older medicines.

The galloping demand for weight-loss drugs has led to a persistent shortage of Wegovy since its market introduction. Consequently, both Novo and Lilly have been investing heavily in expanding their production capacity, with Novo announcing >DKK130bn (c.$18bn) of capacity investment as of 2021. The $11bn acquisition of Catalent’s three manufacturing sites should start bearing fruit from 2026 onwards. Larger capacity should also reduce the competition from US’ compounding pharmacies, which are allowed to make copy-cat versions whenever a drug is in short supply. Moreover, demand should receive a boost in the event that anti-obesity medicines receive US governmental insurance coverage under Medicare and Medicaid (US health insurance programmes for the elderly, and low-income families, respectively) for just their weight-loss benefit (currently, these medicines are covered for obese people with a co-morbidity) – as proposed by the previous Biden government. This development could provide access to the latest anti-obesity medications for 7.4m people under Medicare and Medicaid, which should easily take the sting out of lower prices for Ozempic/Wegovy starting 2027. Note that Novo’s obesity offerings may also find applications in reducing the risk of cardiovascular events, kidney disease, sleep apnoea, alcohol addiction and/or even Alzheimer’s.

While Novo has CagriSema, Amycretin (a once-weekly subcutaneous injection; highest dose produced c.22% weight-loss in an early-stage trial) and a few others to extend its lead in this and even the diabetes market, there are also promising pipeline drug candidates from Eli Lilly, Amgen, Boehringer Ingelheim, Zealand Pharma and others, that could challenge the incumbents. Therefore, we see obesity eventually becoming a multi-player game. For details, refer to our report ‘Pick Your Weight-Loss Molecule’ from December 2024. With the efficacy bar already set high, newer drugs could differentiate themselves through fewer side-effects, dosing frequency and administration convenience (e.g. oral options).

Considering everything, after a 27% top-line CAGR over 2021-24, we expect Novo to sustain the momentum with c.18% and c.16% top-line and bottom-line CAGR, respectively, over the next three years.

Price-levels too good to pass up

Despite the enviable growth prospects, Novo’s shares currently trade at 2025e and 2026e P/Es of c.22x and c.18x, respectively – levels unseen since the Wegovy launch. Our strong upside on Novo is backed by the fundamental and relative valuation parameters. With the FDA declaring the end of the shortage for Ozempic/Wegovy, the shares have perhaps turned a corner. A few more catalysts could provide sales/earnings beats in the coming quarters, and/or any favourable move from the Trump government regarding the anti-obesity drugs’ governmental insurance coverage. In summary, an against-the-wind bet on this high-quality name should pay off handsomely.

Subscribe to our blog

As contrarian born market participants, what would we buy into this quality universe with closed eye?

This is a testament to the new speculative pull of a putative Ukraine reconstruction, while not ever...