MedTechs Need Another COVID

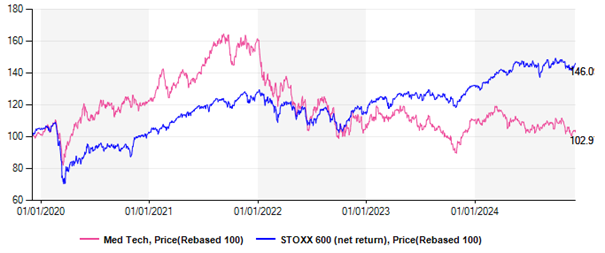

Five years after Covid, the hopes for Medtech have been dashed. The sector, a big component of health ex Pharmas, is barely breaking even after 5 years (see chart). The sector flourished as a result of the Covid-led demand, spent the money on external growth and has seen its legs cut by the 2022 interest rate rise at a time when it was trading at unsustainable multiples.

Medtechs in need of a serious prop

Failing another epidemic, one might have hoped that China would offer the next growth opportunity. That was before mid 2023 when the CCP had another look at regional buying practices and endemic corruption directly linked to the fact that health professionals are under paid. The ensuing fears froze the whole market. It is likely that this opened an opportunity for the domestic players to update their offerings and play the national card.

Growth through consolidation has been a well-established strategy. It is not clear that it has delivered.

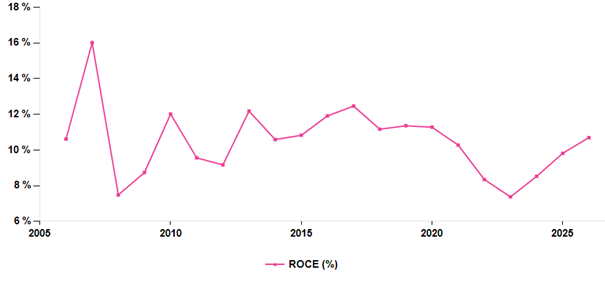

The ROCE of MedTechs has eroded since 2020 and the rebound seen from 2024 may be incorporating a rosy outlook. In any case it is too close to the sector's c. 8.3% Wacc to be of any help. The sector is still digesting its acquisition drive and does not really seem capable of making assets sweat that little bit extra.

MedTech ROCEs fail to impress

Actually assets are sweating more from an Ebit margin standpoint but simply too many assets are required to deliver.

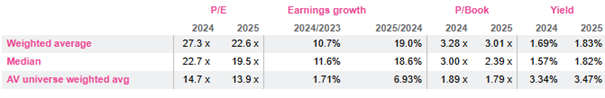

Medtechs have underperformed but remain expensive

Medtechs in need of a serious prop

Failing another epidemic, one might have hoped that China would offer the next growth opportunity. That was before mid 2023 when the CCP had another look at regional buying practices and endemic corruption directly linked to the fact that health professionals are under paid. The ensuing fears froze the whole market. It is likely that this opened an opportunity for the domestic players to update their offerings and play the national card.

Growth through consolidation has been a well-established strategy. It is not clear that it has delivered.

The ROCE of MedTechs has eroded since 2020 and the rebound seen from 2024 may be incorporating a rosy outlook. In any case it is too close to the sector's c. 8.3% Wacc to be of any help. The sector is still digesting its acquisition drive and does not really seem capable of making assets sweat that little bit extra.

MedTech ROCEs fail to impress

Actually assets are sweating more from an Ebit margin standpoint but simply too many assets are required to deliver.

Medtechs have underperformed but remain expensive

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.