Looking for new dividends ? Go for Banks

[dropcap]T[/dropcap]he taste for dividends is largely a reflection on the (shifting) taste for risk but their quality as a safety-net cannot be challenged.

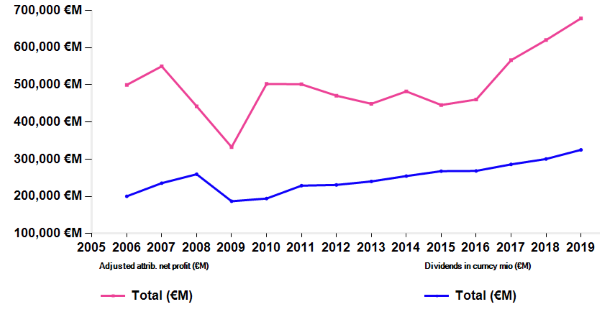

Consider the following chart that plots the dividends paid by the AlphaValue's current coverage over the last 10 years.

But for the unique blow in 2009, when the world was looking like falling apart, it has been a steady rise. This rise happened even in a context of essentially flat earnings.

To be fair, the 2009 collapse was not only due to Banks that divided their payments by a factor of 3.

Pretty much all sectors experienced a dividend contraction with the exception of Pharmas ... and Food Retail. The small cosmetics/household sector also held up well.

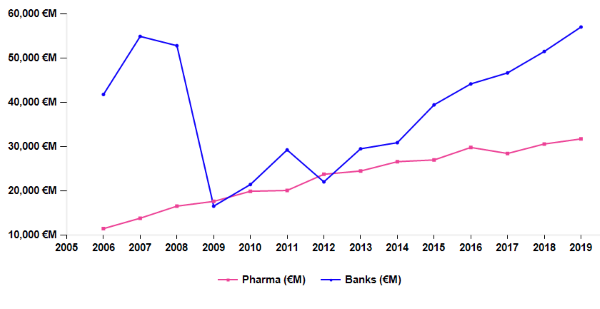

The following chart is a reminder of where the new dividends lie. Banks and Pharmas share similar combined market caps in the AlphaValue coverage. They are respectively the largest and second largest dividend payers.

But their payment history is one of an accelerated recovery for Banks and possibly a degree of interrogation surfacing in Pharmas after 11 years of steady growth.

To be fair, the 2009 collapse was not only due to Banks that divided their payments by a factor of 3.

Pretty much all sectors experienced a dividend contraction with the exception of Pharmas ... and Food Retail. The small cosmetics/household sector also held up well.

The following chart is a reminder of where the new dividends lie. Banks and Pharmas share similar combined market caps in the AlphaValue coverage. They are respectively the largest and second largest dividend payers.

But their payment history is one of an accelerated recovery for Banks and possibly a degree of interrogation surfacing in Pharmas after 11 years of steady growth.

Banks are set to overtake by 2019 the high point of 2007. It is not a too demanding expectation as they have about doubled their equity base to €1.45tn over the period.

Thanking their shareholders for their patience would mean a pay-out of close to €100bn rather than the €57bn currently forecast.

Other sectors are set to stage a neat dividend acceleration (Oils, Autos) but they are certainly more volatile propositions and certainly do not offer the formidable dividend potential that the banks have, once the regulator is a bit more relaxed. This is an upside risk.

Banks are set to overtake by 2019 the high point of 2007. It is not a too demanding expectation as they have about doubled their equity base to €1.45tn over the period.

Thanking their shareholders for their patience would mean a pay-out of close to €100bn rather than the €57bn currently forecast.

Other sectors are set to stage a neat dividend acceleration (Oils, Autos) but they are certainly more volatile propositions and certainly do not offer the formidable dividend potential that the banks have, once the regulator is a bit more relaxed. This is an upside risk.

Rising dividends since 2009

Compared Pharma and Banks combined dividends

Subscribe to our blog

AlphaValue has certainly not been alone over the last 4 months in wondering when too much was to...

A week ago, Reckitt posted splendid Q3 sales lifted by emerging markets demand, while L’Oré...