Jeronimo Could Have Carrefour For Breakfast

Carrefour to explore options to boost its valuation

On Tuesday, press articles on Bloomberg mentioned that Carrefour was exploring new options to boost its valuation. Amongst other options, the company could explore an outright sale to either a Private Equity fund or an industrial player. This willingness to boost its valuation is directly linked to the massive underperformance of Carrefour vs its peers. Notably when compared with Jeronimo Martins. Indeed, over the last ten years, the Jeronimo Martins share price is up by 226% while the sector is only up by 91% and Carrefour down by 16%.

A tale of two growth profiles

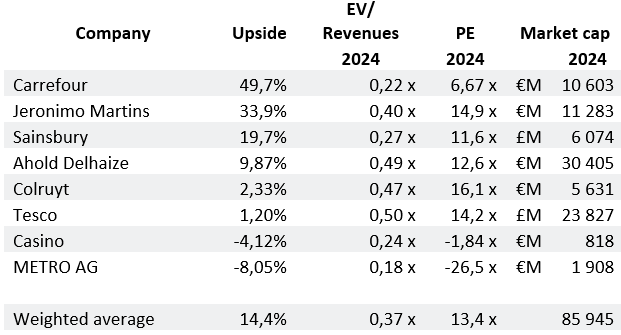

Jeronimo Martins now has a market cap of EUR11.6bn, slightly ahead of that of Carrefour (EUR10.6bn). The following table shows the key valuation metrics for the sector and, as one can see, the valuation gap between these two is massive.

The reason behind this massive gap is simple: organic growth and format. Jeronimo Martins' market dominance in faster-growing Poland under its Biedronka brand has been its key feature, now complemented by promising growth in Colombia. The following graph summarizes the top-line growth at both Carrefour and Jeronimo Martins since 2007. Jeronimo Martins has consistently massively outperformed Carrefour for the last 17 years. Carrefour’s Brazilian successes have been insufficient to offset the French domestic operations going nowhere.

Compared sales growth Carrefour (blue) vs. Jeronimo Martins (pink)

Simulating a 100% takeover of Carrefour by Jeronimo Martins : a no-brainer

AlphaValue's M&A tools enable its subscribers to simulate the impact of a takeover for any pair of companies within its database. The economics of an acquisition of Carrefour by Jeronimo Martin are just a click away. They are quite attractive at the current relative valuations.

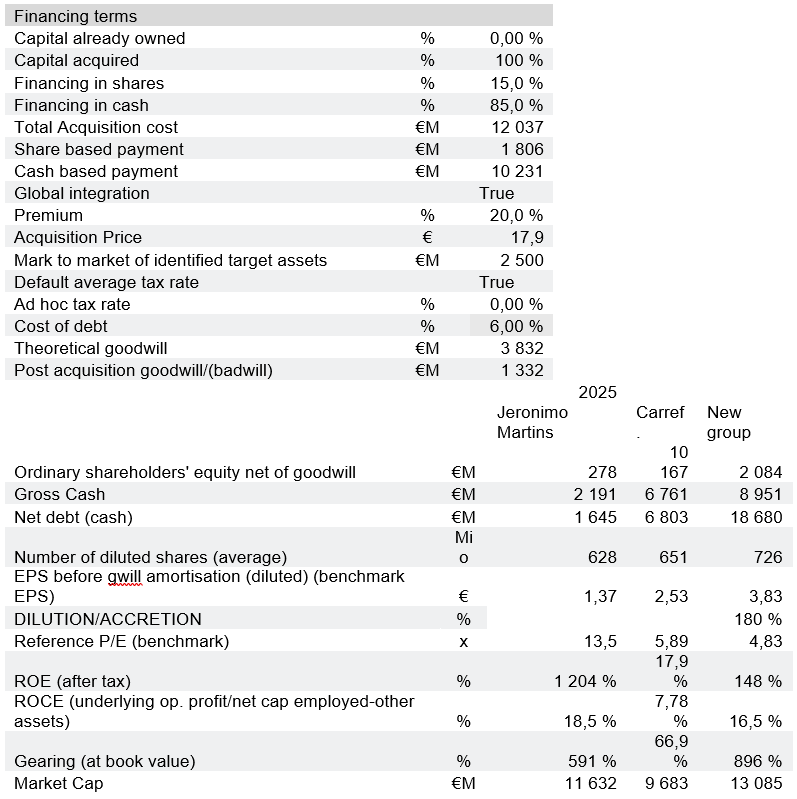

The following hypotheses have been embarked. They are pretty much default ones:

- A 20% premium on Carrefour's last share price (i.e. an acquisition at EUR17.9 per share)

- A 15% in shares/85% in cash bid with a cost of debt at 6%. This ratio is such that the family retains a quasi majority of the new company.

Synergy assumptions are always heroic. Here they are assumed to be minimal and limited to joint purchasing power helping to attain better terms. This is set at €1bn in 2025 and €2bn in 2026 or respectively X% of the cost base.

On the back of these hypotheses, the deal would be massively earnings enhancing at +108% in year 1, +180% in year 2 and +240% in Year 3. As we all know, EPS enhancement and value creation are two different things but, in this case. the ROCE for the New Co in year 3 would stand at 20.4%, ahead of that of Jeronimo Martins for that same year (19.1%).

Of course, any such bid would radically transform Jeronimo Martins and give it massive exposure to the more-mature European market, which could be tricky to manage. Or it could sell piecemeal the French operations to the various local players and keep the Brazilian assets.

From a financial standpoint, the deal is a no-brainer. From a strategic one it is for the JMT owners to decide where to stop in their asset build up. From a political perspective, the French government would find it difficult to stop an acquisition by a European firm with excellent credentials.

Detailed xls with all financials available on request.

On Tuesday, press articles on Bloomberg mentioned that Carrefour was exploring new options to boost its valuation. Amongst other options, the company could explore an outright sale to either a Private Equity fund or an industrial player. This willingness to boost its valuation is directly linked to the massive underperformance of Carrefour vs its peers. Notably when compared with Jeronimo Martins. Indeed, over the last ten years, the Jeronimo Martins share price is up by 226% while the sector is only up by 91% and Carrefour down by 16%.

A tale of two growth profiles

Jeronimo Martins now has a market cap of EUR11.6bn, slightly ahead of that of Carrefour (EUR10.6bn). The following table shows the key valuation metrics for the sector and, as one can see, the valuation gap between these two is massive.

The reason behind this massive gap is simple: organic growth and format. Jeronimo Martins' market dominance in faster-growing Poland under its Biedronka brand has been its key feature, now complemented by promising growth in Colombia. The following graph summarizes the top-line growth at both Carrefour and Jeronimo Martins since 2007. Jeronimo Martins has consistently massively outperformed Carrefour for the last 17 years. Carrefour’s Brazilian successes have been insufficient to offset the French domestic operations going nowhere.

Compared sales growth Carrefour (blue) vs. Jeronimo Martins (pink)

Simulating a 100% takeover of Carrefour by Jeronimo Martins : a no-brainer

AlphaValue's M&A tools enable its subscribers to simulate the impact of a takeover for any pair of companies within its database. The economics of an acquisition of Carrefour by Jeronimo Martin are just a click away. They are quite attractive at the current relative valuations.

The following hypotheses have been embarked. They are pretty much default ones:

- A 20% premium on Carrefour's last share price (i.e. an acquisition at EUR17.9 per share)

- A 15% in shares/85% in cash bid with a cost of debt at 6%. This ratio is such that the family retains a quasi majority of the new company.

Synergy assumptions are always heroic. Here they are assumed to be minimal and limited to joint purchasing power helping to attain better terms. This is set at €1bn in 2025 and €2bn in 2026 or respectively X% of the cost base.

On the back of these hypotheses, the deal would be massively earnings enhancing at +108% in year 1, +180% in year 2 and +240% in Year 3. As we all know, EPS enhancement and value creation are two different things but, in this case. the ROCE for the New Co in year 3 would stand at 20.4%, ahead of that of Jeronimo Martins for that same year (19.1%).

Of course, any such bid would radically transform Jeronimo Martins and give it massive exposure to the more-mature European market, which could be tricky to manage. Or it could sell piecemeal the French operations to the various local players and keep the Brazilian assets.

From a financial standpoint, the deal is a no-brainer. From a strategic one it is for the JMT owners to decide where to stop in their asset build up. From a political perspective, the French government would find it difficult to stop an acquisition by a European firm with excellent credentials.

Detailed xls with all financials available on request.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.