Elekta's Cinderella story has a long way to go

When we last teased on Elekta’s investment case in October 2022, Elekta grabbed the investors’ much-needed attention (up >35% since then) as Chinese (c.16% of sales) re-opening in late-2022 and gradually easing supply chain challenges triggered an operating revival. Sustained innovation (also the firm’s USP) was an added catalyst. That said, the journey hasn’t been a smooth ride as the re-rating was on-and-off dampened by 1/ China’s corruption clampdown on its healthcare sector during July-August 2023; and 2/ a disappointing Q3 outlook in November 2023. Also, despite a healthy run in the last 18 months, the stock is still trading c.40% below its pre-pandemic levels. Prior to October 2022, the share price has also been negatively impacted by recessionary fears due to rapidly-rising interest rates that reduced visibility for capex-heavy installations.

Massive underperformance still!

Ongoing improvements, but a lot more is needed

Following FY22/23 sales growth of just 4% (in CER terms), held back by COVID-19 restrictions in China and supply chain challenges, which impacted its installations, Elekta reported 8% growth in 9M FY23/24. This improvement was attributed to easing component shortages, resulting in better order book conversion, and market share gains. Even the adjusted EBIT margin improved by 370bp to 11.4%. Interestingly, despite higher investments, ‘reported’ cash shortfall after continuous investments reduced materially in 9M FY23/24 (-SEK57m vs. -SEK1.2bn in 9M FY22/23), thanks to better earnings and working capital efficiencies. Still, the gross order intake (-7%) was impacted by the anticorruption drive in China and tough comps in Europe.

While the Q4 operating performance is guided to remain in line with that of previous year – given that the comparable quarter was exceptional (10% sales growth and 16.2% adjusted EBIT margin) - further improvements should materialise in the coming quarters/years, backed by volume growth, gradual price hikes, easing supply chain worries, cost reduction initiatives and productivity improvements.

Besides Elekta, even close competitor Varian, part of Siemens Healthineers, clocked all-the-more promising operational results – FY22/23 (September-ending) sales growth of 14.8% and an adjusted EBIT margin of 15.1%. Even the Q1 FY23/24 performance was unmatchable – sales growth of 22.3% and an adjusted EBIT margin of 15.9%. In effect, the much-awaited industry-wide recovery is finally underway.

Innovation quotient to remain the key driver

The product-level developments of the past few months are an important vote ofconfidence in Elekta’s innovation prowess. In May 2023, the firm launched ‘Elekta One’,offering a complete suite of end-to-end applications by bringing software products,solutions and services under one umbrella. Furthermore, the company is targeting anefficiency improvement in clinics of c.50% via smarter workflows, improved automation andby learning from every patient treated.

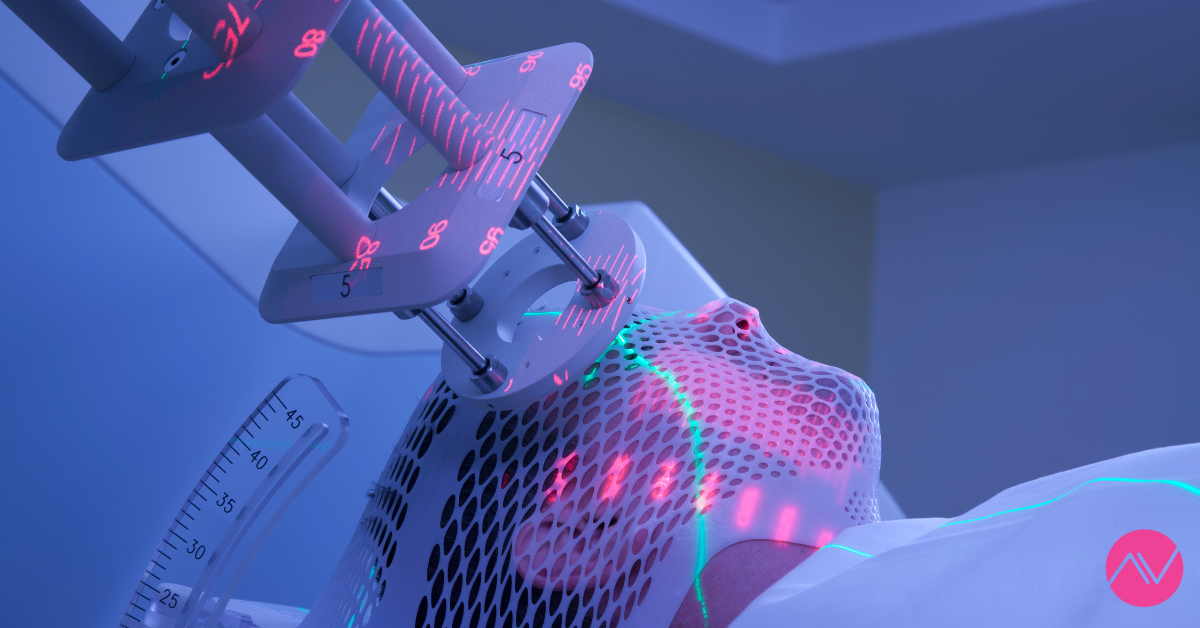

Notably, the high-margin ‘Unity’ (MR-Linac; which can treat >40 indications) has been gaining traction as it has received both CE and FDA 510(k) clearance for its comprehensive motion management with true tracking and automatic gating functionalities. With these features, the radiation beam is automatically turned off when the tumour moves outside of the beam, ensuring more precision without additional set-up time for the user. Most importantly, the true tracking feature positions Unity as the ‘only’ linac in the radiotherapy space to provide continuous tracking of the 3D position of any target in realtime, non-invasively and without surrogates. At end-FY22/23, a total of 75 units were installed / under installation (FY23/24e figure could be c.100). Hence, Unity’s need for big bunker rooms no longer seems to be a major stumbling block.

Separately, after receiving the CE mark in August 2022, Elekta Esprit (latest Leksell Gamma Knife radiosurgery platform; offering considerably faster automated treatment planning, and more personalised radiosurgery, with better accuracy) received FDA 510(k) clearance in October 2022.

The strategic focus remains on underpenetrated markets

Note that the global radiation therapy markets are expected to grow at a 8% CAGR to $14.9bn by 2032 – as per Precedence Research - underpinned by technological advances, a still-rising incidence of cancer and a growing awareness around radiation therapy in cancer treatment. In line with its ACCESS 2025 strategy, Elekta focuses on low- and middle-income geographies, which have a much lower patient population per installed base vs. the developed regions. In February 2023, Elekta acquired a solution and service distributor in Thailand – an underpenetrated region considering that there are only 1.5 linacs per million population vs. 5.1 in high-income countries - while the Thai government is also targeting a reduction in radiation therapy waiting time from twelve to six weeks. Furthermore, in March 2023, the Swedish firm signed a joint venture with China National Pharmaceutical Group (Sinopharm) to tap the lower-tier cities (targeting c.70% of population; 1k medical institutions within the Sinopharm network). Although China is aiming to become self-sufficient in critical technologies, the potential shift is unlikely to impact Elekta’s dominance in the region (>50% market share), given the indispensable and innovative nature of its offerings, and the lack of a local competitor with the breadth of Elekta’s offerings.

Achievable mid-term promises

In term of outlook, the management expects a >7% sales CAGR between FY22/23 and FY24/25, underpinned by recovering end-markets, increasing sales of Unity & software and price hikes. Region-wise, the emerging markets are anticipated to grow at an 8T to 10% CAGR and the mature markets at 2-4%. Interestingly, product-wise, Software is guided to grow by 7-9% and Solutions by 5-7%. Moreover, the market’s expectations of rate cuts, although delayed, in 2024 should pave the way for a further recovery in hospital capex. Lastly, the order backlog of SEK42bn (i.e. >2 years of sales) also provides healthy top-line growth visibility.

Still a bargain buy!

Despite Elekta likely to clock better results (in absolute terms) than in any year since FY13/14, the shares are trading at a FY23/24e PE of c.20x vs. a five-year average of c.34x and 30x for AV MedTechs. Our c.59% upside on Elekta is supported by all the AV valuation parameters. Importantly, the firm’s improving FCFs i.e. an average of SEK1.3bn over the next three years vs. average SEK867m during FY16/17-FY22/23 should help strengthen an already healthy balance sheet (FY23/24e net debt-to-EBITDA of 1.2x). The dividend is thus safe including for the Leksell family (5.9% stake and 30.4% voting rights). As a deeply-discounted healthy-dividend paying (3.3% yield) medtech, Elekta certainly shines next to its bigger-sibling i.e. Philips, which continues to try hard to win back the markets’ confidence.