French State Listed Holdings Should Be Sold Now

With a massive budget hole widening by the day (6% in 2024 although below 5% had been targeted), the new French government would give a good signal to worried global markets by dumping the c.€71bn that it owns in a small number of French companies. The rationale for sticking with these holdings is nil. Where there are genuine strategic issues (say Airbus or Thales), a golden share can do the trick at no capital cost. It is actually a shame that such golden shares do not exist already. One could even argue that it was not even necessary for the French state to own a golden share to get Couche-Tard to abandon its deal for Carrefour.

It is relatively difficult to show the long-term performance of this State portfolio as the universe has changed a bit and AlphaValue does not have the portfolio management tools to work out the ins and outs over time.

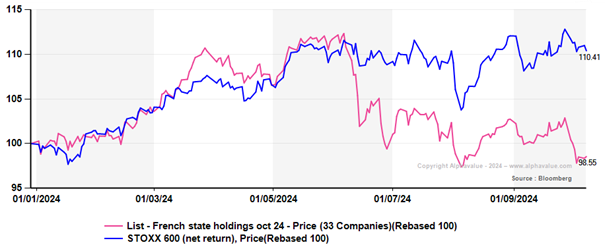

Ytd the value of the French State holdings has however fallen as the French signature has taken a beating since the June 2024 snap elections and ensuing total political disarray. Spreads have gained 70-80bp against the Bund. The chart below is weighted along actual holdings of the 33 stocks identified by AlphaValue as part of its existing coverage.

All the following metrics are based on this universe and are bound to be incomplete and prone to error as the information is shifting and sometimes hard to grasp. As a reminder most of these holdings are held through Caisse des Dépôts or BPI.

French State holdings have underperformed of late, like the CAC40

It is relatively difficult to show the long-term performance of this State portfolio as the universe has changed a bit and AlphaValue does not have the portfolio management tools to work out the ins and outs over time.

Ytd the value of the French State holdings has however fallen as the French signature has taken a beating since the June 2024 snap elections and ensuing total political disarray. Spreads have gained 70-80bp against the Bund. The chart below is weighted along actual holdings of the 33 stocks identified by AlphaValue as part of its existing coverage.

All the following metrics are based on this universe and are bound to be incomplete and prone to error as the information is shifting and sometimes hard to grasp. As a reminder most of these holdings are held through Caisse des Dépôts or BPI.

French State holdings have underperformed of late, like the CAC40

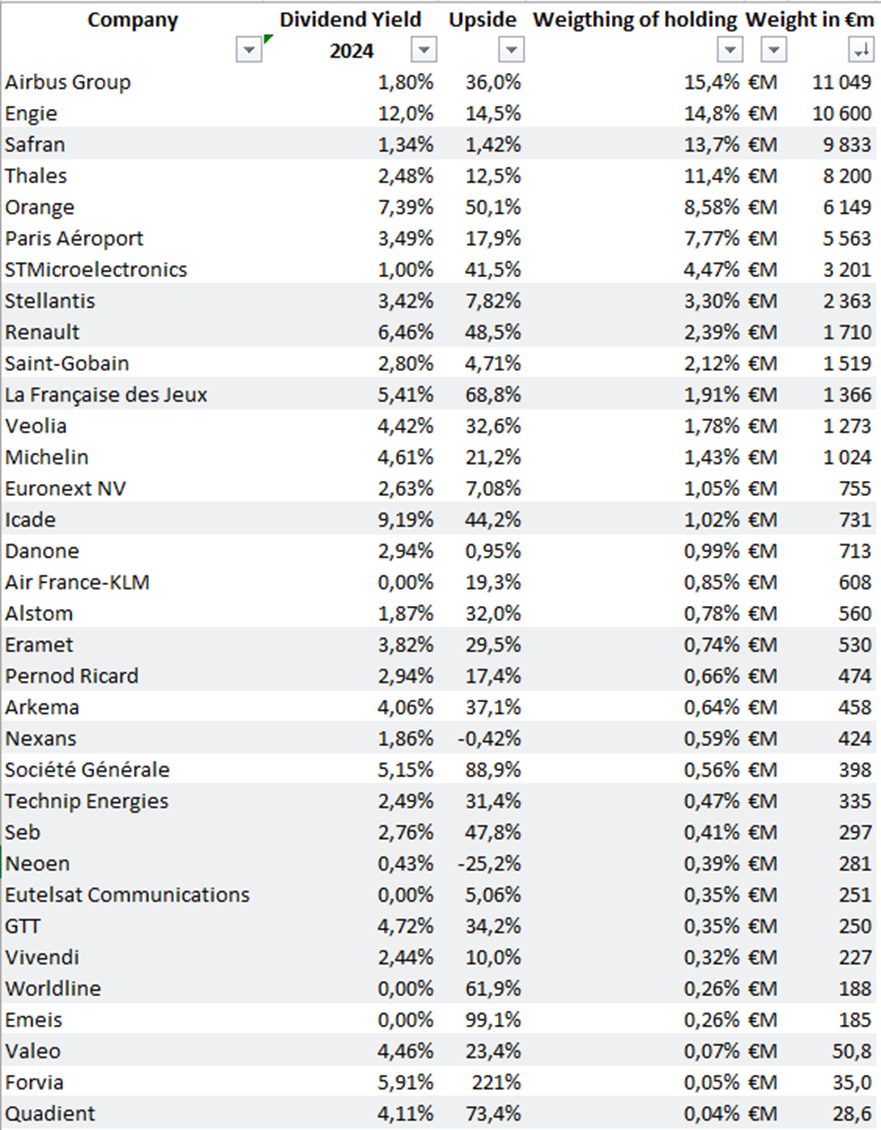

Here is the list of those holdings by declining value. Again it should be regarded as indicative. Target prices are computed for minority holders in a secondary market, not for a strategic holding. The weighted yield is about 4.4% which is not too bad vs. the 3.5% average for European equities.

Subscribe to our blog

As contrarian born market participants, what would we buy into this quality universe with closed eye?

This is a testament to the new speculative pull of a putative Ukraine reconstruction, while not ever...