DEBT/EBITDA >4X

AlphaValue is of the opinion that FY 2025 will end up being painful: earnings will have to be trimmed and FCF will disappoint as a result of the Trump-induced chaos.

The next question is whose balance sheets might be at risk? The most telling tracking ratio remains net debt /ebitda, with the caveat that Ebitda is as good as what managers try to get the markets to believe. A quick Ebitda resiliency test is how much of Ebitda converts into FCF and how much trimming net earnings have already suffered over the last 12 months.

Bearing this in mind and after excluding Real Estate and Financials at large, we see 38 stocks with an adjusted net debt/Ebitda worth discussing that break down into three categories.

The first category is Utilities and Concessions. Utilities are deemed to be safe but remember that they tend to rely on the banks to pay their dividends. Any demand hit will only worsen the case of a sector which is pretty extended at 5.6x Ebitda and no FCF to show for itself. The exceptions to this disappointing observation are ERG, Getlink, Ferrovial and United Utilities. They have high gearing ratios but can cope. Others are likely to suffer from tightening financial conditions.

The second group is composed of well-known and reasonably-big corporates with worrying signals about their earnings and FCF conversion dynamics. That list would include:

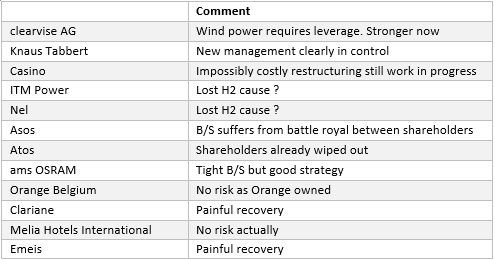

And finally stories with current weak legs would include the following stocks with market caps of less than €2bn. Investors in these equities are deemed to be aware that their businesses and balance sheets have been and remain question marks.

The next question is whose balance sheets might be at risk? The most telling tracking ratio remains net debt /ebitda, with the caveat that Ebitda is as good as what managers try to get the markets to believe. A quick Ebitda resiliency test is how much of Ebitda converts into FCF and how much trimming net earnings have already suffered over the last 12 months.

Bearing this in mind and after excluding Real Estate and Financials at large, we see 38 stocks with an adjusted net debt/Ebitda worth discussing that break down into three categories.

The first category is Utilities and Concessions. Utilities are deemed to be safe but remember that they tend to rely on the banks to pay their dividends. Any demand hit will only worsen the case of a sector which is pretty extended at 5.6x Ebitda and no FCF to show for itself. The exceptions to this disappointing observation are ERG, Getlink, Ferrovial and United Utilities. They have high gearing ratios but can cope. Others are likely to suffer from tightening financial conditions.

The second group is composed of well-known and reasonably-big corporates with worrying signals about their earnings and FCF conversion dynamics. That list would include:

And finally stories with current weak legs would include the following stocks with market caps of less than €2bn. Investors in these equities are deemed to be aware that their businesses and balance sheets have been and remain question marks.

Subscribe to our blog

A week ago, Reckitt posted splendid Q3 sales lifted by emerging markets demand, while L’Oré...

AlphaValue resuscitated its 20-year Ebitda margin chart (ex Banks and Deep Cyclicals) and continu...