Apprentice sorcerers at work

Undoing world trade is about quick populist wins, subsequent massive pains, probably conficts and impossibly long and costly reconstruction.

Once upon a time, apprentice sorcerers were bankers, both too imaginative and too greedy.

It took 10 years to clean up the mess with a handy tool called free money. Apprentice sorcerers these days are politicians (greedy as well, not as smart) while there is no central bank to dilute the bill.

The outcome of these follies may just be greater pains.

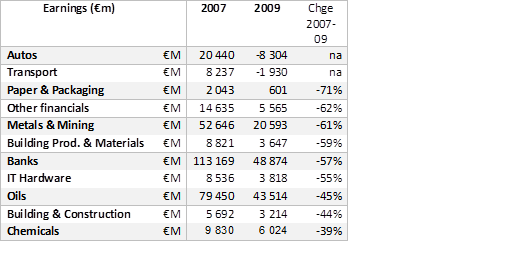

For a taste of what happens when fear engulfs markets, walk back 10 years. When the world grounded to a halt by Q4 18 and Q1 19, the 2019 earnings ended up 38% lower than in 2007 their previous peak (€559bn).

The following sectors all lost more than the average. Please pay attention to the massive losses of the car sector.

Now consider travelling between 2017 (our new 10-year peak earnings) and 2019. In AlphaValue's current estimates (i.e. before the Trump administration lost its mind), earnings were expected to go up by 19% to €686bn (not strictly comparable to the universe used for 2007-09).

Now assume that each sector loses by 2019 in proportion to what it lost in percentage terms between 2007 and 2009. That makes a combined 29% contraction and €411bn. Or €275bn missing.

These are kind computations as we assumed that sectors that lost money in 2009 will only retreat by 50% between 2017 and 2019.

Is a trade crisis worse than a financial crisis? Of course yes, since it leads to a financial crisis anyway. Are banks better equipped to weather such a moment? Presumably.

Does the market want to test? Certainly not. Just look at the loss of altitude of the banking sector over the last month.

Banks say: run!

Now consider travelling between 2017 (our new 10-year peak earnings) and 2019. In AlphaValue's current estimates (i.e. before the Trump administration lost its mind), earnings were expected to go up by 19% to €686bn (not strictly comparable to the universe used for 2007-09).

Now assume that each sector loses by 2019 in proportion to what it lost in percentage terms between 2007 and 2009. That makes a combined 29% contraction and €411bn. Or €275bn missing.

These are kind computations as we assumed that sectors that lost money in 2009 will only retreat by 50% between 2017 and 2019.

Is a trade crisis worse than a financial crisis? Of course yes, since it leads to a financial crisis anyway. Are banks better equipped to weather such a moment? Presumably.

Does the market want to test? Certainly not. Just look at the loss of altitude of the banking sector over the last month.

Banks say: run!

Can it be nastier than the experience of 10 years ago? We think so. Whether a BMW or a Gucci bag sell less with a 25% price increase due to tariffs is a moot point.

The invisible frictions building up in the real world of a formidably complex web of exchange of subparts, parts and products are a growth extinctor and quite possibly a deflator.

The debate between cheap money to prop up the suddenly stalled economies or high rates to fend off inflation driven by tariffs/lack of competition is just starting. A new valuation regime is most likely to ensue.

For more analysis, trial our research : www.alphavalue.com

Can it be nastier than the experience of 10 years ago? We think so. Whether a BMW or a Gucci bag sell less with a 25% price increase due to tariffs is a moot point.

The invisible frictions building up in the real world of a formidably complex web of exchange of subparts, parts and products are a growth extinctor and quite possibly a deflator.

The debate between cheap money to prop up the suddenly stalled economies or high rates to fend off inflation driven by tariffs/lack of competition is just starting. A new valuation regime is most likely to ensue.

For more analysis, trial our research : www.alphavalue.com

Subscribe to our blog

AlphaValue has certainly not been alone over the last 4 months in wondering when too much was to...

A week ago, Reckitt posted splendid Q3 sales lifted by emerging markets demand, while L’Oré...