ANOTHER NAIL IN THE ESG COFFIN?

AlphaValue puts the emphasis on the consistency of its ESG ratings both across its coverage and over time. Simple data but comparable. It is thus possible to look at the dynamic of the E, S and G metrics as well as at that of the more elusive concept of sustainabilit.

Sadly, historical data is only slowly building up as consistent environmental data has only been available since 2019 with environmental scoring starting in 2021. This is however enough to look back and cross check:

- Whether stocks with the best environmental scores do well performance wise.

- Whether stocks with the worst environmental scores are actual dogs.

The answer is that the jury is still out.

As for the stocks with the best scores back in 2021 (we relied on the top 50 within a 550 universe), the average score has remained unchanged at 7/10 over the period.

Here is their 5-year performance, showing 40% outperformance on an equal weighting basis.

Good environmental stocks performance: good overall performance

At the other extreme, i.e. the 50 stocks with the worst environmental scores back in 2021, their combined score has actually improved which is a positive development in absolute terms.

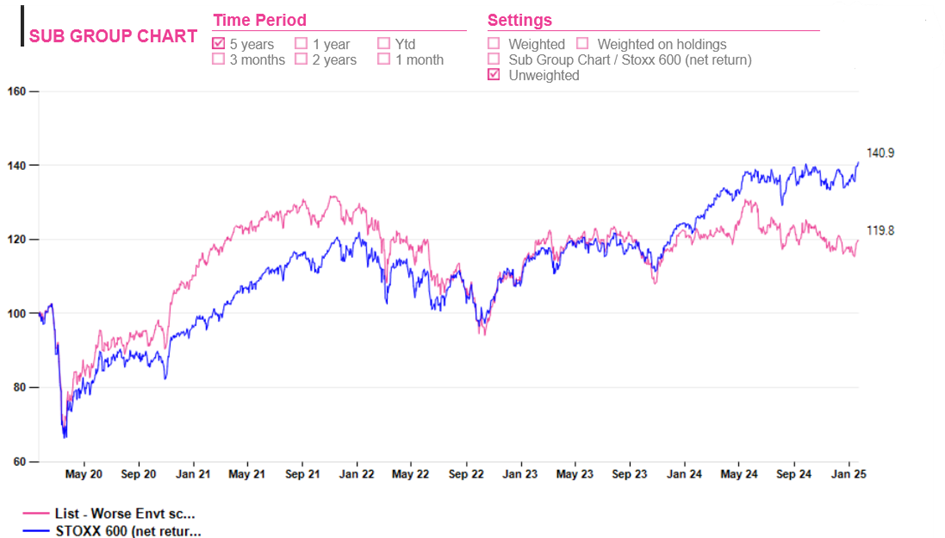

And here is the 5-year performance for this universe of stocks with poor environmental metrics, here again equally weighted.

Poor environmental stocks performance: not a drama

In a theoretical long-short approach to investment, an environmental score-based stock selection might look effective performance wise.

The caveat is however that good environmental scores are a feature of good stocks. They would have gone up anyway. It is not clear whether another group of stocks with a strong business model and selected on another filter (momentum? pay outs? governance?) might have done better. Below is a summary view of that universe.

As for the laggards, their underperformance is not that much over 5 years. They are also low-quality stocks (see next table) so it is hard to ascribe their underperformance to environmental factors alone.

The long and short of it is that the jury is still out and buying into the E of ESG is really a tautology as it amounts to buying into quality.

Sadly, historical data is only slowly building up as consistent environmental data has only been available since 2019 with environmental scoring starting in 2021. This is however enough to look back and cross check:

- Whether stocks with the best environmental scores do well performance wise.

- Whether stocks with the worst environmental scores are actual dogs.

The answer is that the jury is still out.

As for the stocks with the best scores back in 2021 (we relied on the top 50 within a 550 universe), the average score has remained unchanged at 7/10 over the period.

Here is their 5-year performance, showing 40% outperformance on an equal weighting basis.

Good environmental stocks performance: good overall performance

At the other extreme, i.e. the 50 stocks with the worst environmental scores back in 2021, their combined score has actually improved which is a positive development in absolute terms.

And here is the 5-year performance for this universe of stocks with poor environmental metrics, here again equally weighted.

Poor environmental stocks performance: not a drama

In a theoretical long-short approach to investment, an environmental score-based stock selection might look effective performance wise.

The caveat is however that good environmental scores are a feature of good stocks. They would have gone up anyway. It is not clear whether another group of stocks with a strong business model and selected on another filter (momentum? pay outs? governance?) might have done better. Below is a summary view of that universe.

As for the laggards, their underperformance is not that much over 5 years. They are also low-quality stocks (see next table) so it is hard to ascribe their underperformance to environmental factors alone.

The long and short of it is that the jury is still out and buying into the E of ESG is really a tautology as it amounts to buying into quality.

Subscribe to our blog

As contrarian born market participants, what would we buy into this quality universe with closed eye?

This is a testament to the new speculative pull of a putative Ukraine reconstruction, while not ever...