New targets for French power mix

The French parliament adopted last week new energy commitments for the next decade. France is now on board; it has joined the increasing list of European countries targeting to be carbon-free by 2050, with a mid-term renewables target of c.33% by 2030. This is an encouraging step to face climate change and meet renewable targets. Although all wind OEMs that we have under coverage should benefit from this, Vestas is, in our view, better positioned than its peers.

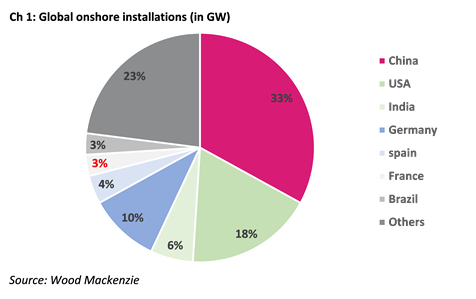

At the end of 2018, the global onshore installations base amounted to c.540GW.

France is still relatively small (see chart 1) compared to its European neighbours and worldwide. With only 3% of global onshore installations, France has three times less wind capacity than Germany, which is the largest player in Europe. We expect, however, to see an acceleration in its installations over the next decade.

Improving the power mix

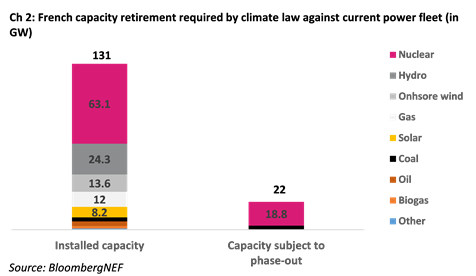

France is moving gradually toward a greener power mix. The country has identified as much as 22GW which could be closed down by 2035 (see chart 2). Out of this total, there is c.3GW of coal which will be shut down by 2022. The reduction in nuclear will be more moderate, with 14 reactors expected to be closed by 2035. Based on estimates mentioned by BloombergNEF, the lifetime extension of reactors over 2014-30 could cost up to €100bn, while the cost of dismantling one reactor should range between €350m and €1.3bn. Lastly, it is worth noting that the shortfall in capacity will not be replaced by gas.

Good news for both the onshore and offshore wind market

To date, the main drag to accelerating onshore wind projects in France was related to permits and uncertainties of obtaining environmental authorisations. Looking forward, we believe the latest climate law as defined by Parliament gives more clarification and visibility for investors.

As regards offshore wind, we also see the recent announcements as more supportive for future volumes in this market with auctions of around 1GW per year until 2024, which is twice as high as what France had targeted in January 2019.

Which OEM to play?

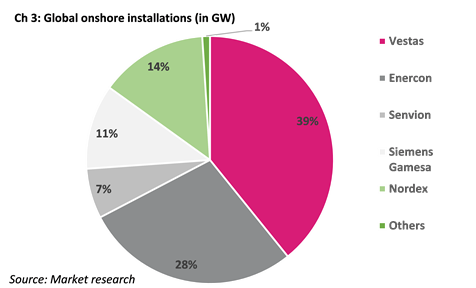

We believe that all wind OEMs that we have under coverage, such as Vestas, SGRE and Nordex, are well positioned to capture future growth in France. If the question is which one to play in offshore, there are only two players operating in this market, i.e. Vestas and Siemens Gamesa. Our preference is clearly Vestas (see chart 3).

Regarding onshore wind, we prefer to play Vestas and Nordex. The latter having increased its market share to c.14% from c.10%, we consider it is now better positioned in France compared to Siemens Gamesa.

France’s decisions on renewables are not isolated actions and that is why we believe that installations in Europe should accelerate over the next decade. We have to be rational; there aren’t many alternatives if France wants to achieve a carbon-free target by 2050. As mentioned above, we prefer Vestas if the strategy is to play both onshore and offshore. Nordex also appears to be a good alternative to play the onshore market, especially in France.

Learn more about AlphaValue's research on renewables : click here