AI Capex Bubble Valuations For How Long?

AlphaValue has certainly not been alone over the last 4 months in wondering when too much was too much,as measured by OpenAI capex follies. $1.5Tn is a senseless capex figure that has fired up the valuations of AI capex providers and sundry.

These capex ambitions were and remain absurd, to the extent that up until last week OpenAI was not incorporated as a for-profit, and could thus only agree to business in principle, but not sign contracts with the small print attached. Lawyers and investment banks have now entered the dance, and are most likely prone to throw cold water on those delirious plans.

The next question is whether the adults in the room will limit access to the punch bowl. Adults will want a budget with a P&L that can at least service interest. Indeed, purported equity injected into the mushrooming initiatives is of the round tripping sort: not available when you need it. Debt it is that will finance these insane investments, if they ever take place. A $25bn debt raise is now the daily pace, with $200bn announced in total by last weekend, in an FT quote.

Private debt fund managers have a burning desire to invest excess resources, but again, will/should want to see a business plan.

The bet is that the production of acceptable business plans will not happen and that the decision chain behind those AI excesses is set to be questioned, and may grind to a halt.

Buy buy buy

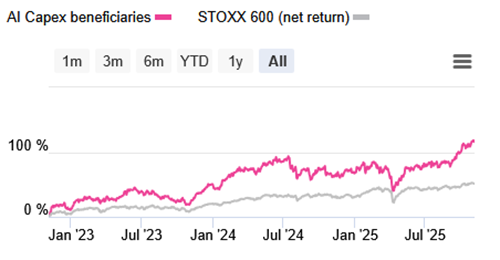

For now such speculative worries have not percolated into the 25 European capex related stocks that surf on those US AI/capex plans. AlphaValue had designed a list for risk takers on the AI Capex dynamic.

Below is the performance of this magic list: up and accelerating since the April 2025 market dip. However, the bulk of the gain started in early September, so that this bubble is 2-months old by now.

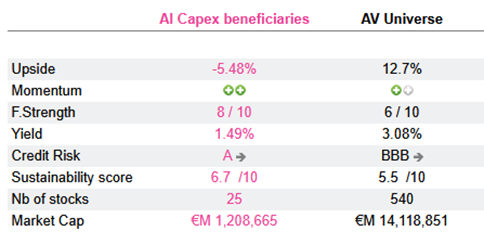

The good news is that those combined 25 stocks are top notch issuers as made clear by the following table: formidable business models, strong balance sheets and sustainability compliant.

A shame that their upside potential has been used up.

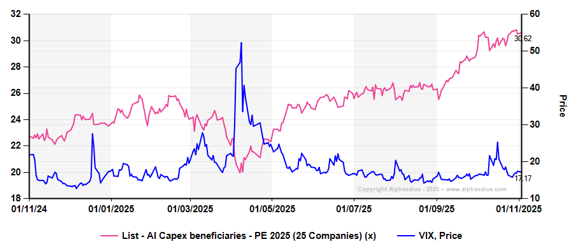

Here is a valuation table that will confirm that indeed valuations are stretched:

Next is the risk of delays

First, funding delays, as ambitious AI projects clash with cash-flow reality.

Then, operational bottlenecks: securing power today, hiring thousands of engineers to connect, power up and cool tens of thousands of GPUs by site.

Hopefully we are wrong. If not, consider that the above PE could plunge below 20x before entering the dance floor again.

Our warm thanks to OpenAI for reintroducing a welcomed degree of volatility in markets.

Fear not: Vix (blue) vs. AI Capex 2025 PE (pink, lhs)

25 AI capex list available can be found live and constantly monitored here AlphaValue - Tools - Company Finder.

These capex ambitions were and remain absurd, to the extent that up until last week OpenAI was not incorporated as a for-profit, and could thus only agree to business in principle, but not sign contracts with the small print attached. Lawyers and investment banks have now entered the dance, and are most likely prone to throw cold water on those delirious plans.

The next question is whether the adults in the room will limit access to the punch bowl. Adults will want a budget with a P&L that can at least service interest. Indeed, purported equity injected into the mushrooming initiatives is of the round tripping sort: not available when you need it. Debt it is that will finance these insane investments, if they ever take place. A $25bn debt raise is now the daily pace, with $200bn announced in total by last weekend, in an FT quote.

Private debt fund managers have a burning desire to invest excess resources, but again, will/should want to see a business plan.

The bet is that the production of acceptable business plans will not happen and that the decision chain behind those AI excesses is set to be questioned, and may grind to a halt.

Buy buy buy

For now such speculative worries have not percolated into the 25 European capex related stocks that surf on those US AI/capex plans. AlphaValue had designed a list for risk takers on the AI Capex dynamic.

Below is the performance of this magic list: up and accelerating since the April 2025 market dip. However, the bulk of the gain started in early September, so that this bubble is 2-months old by now.

The good news is that those combined 25 stocks are top notch issuers as made clear by the following table: formidable business models, strong balance sheets and sustainability compliant.

A shame that their upside potential has been used up.

Here is a valuation table that will confirm that indeed valuations are stretched:

Next is the risk of delays

First, funding delays, as ambitious AI projects clash with cash-flow reality.

Then, operational bottlenecks: securing power today, hiring thousands of engineers to connect, power up and cool tens of thousands of GPUs by site.

Hopefully we are wrong. If not, consider that the above PE could plunge below 20x before entering the dance floor again.

Our warm thanks to OpenAI for reintroducing a welcomed degree of volatility in markets.

Fear not: Vix (blue) vs. AI Capex 2025 PE (pink, lhs)

25 AI capex list available can be found live and constantly monitored here AlphaValue - Tools - Company Finder.

Subscribe to our blog

A week ago, Reckitt posted splendid Q3 sales lifted by emerging markets demand, while L’Oré...

AlphaValue resuscitated its 20-year Ebitda margin chart (ex Banks and Deep Cyclicals) and continu...