Long Oils After All?

Trump's incantatory discourse about ever-more oil to the greater benefit of the American citizen has always sounded strange as it is aimed at pleasing both voters and Texan producers - something of a contradiction in terms.

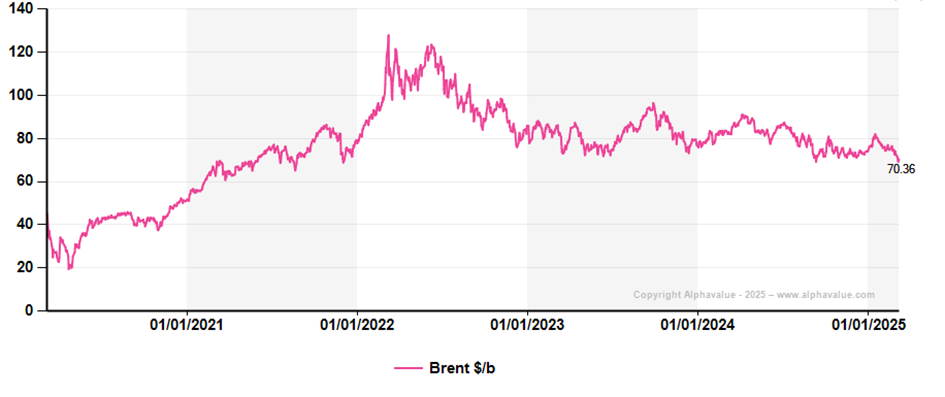

The markets have sorted out the conundrum by pushing prices lower: the consumer wins, for now.

Trump’s Brent back to a 3-year low at $70

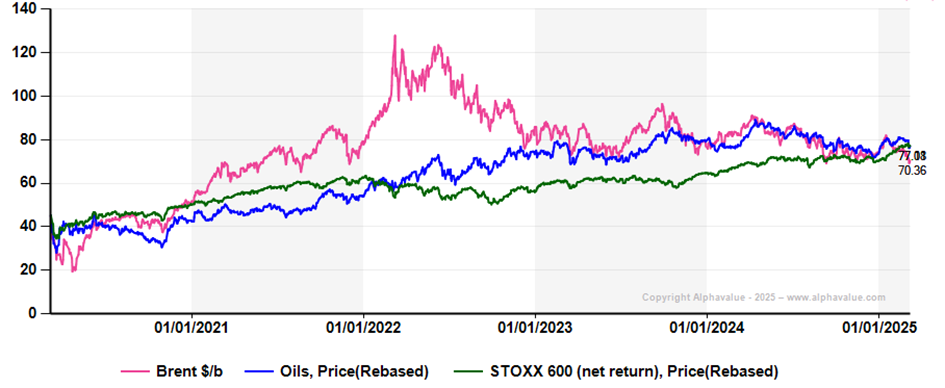

Interestingly with or without Trump’s weird economics, European-listed Oils have fared comparatively well, i.e. in line with the index as it happens. Their share prices have proved to be not that impressed by the 2022 inflationary peaks of various energies.

Big Oils (blue) match the Stoxx600 over 5 years

The oil story shifted to one of natural gas and then to LNG as Russia disappeared from the supply picture. Crude or gas has always been a political story with OPEC holding more or less sway and essentially none when shale based molecules started to flow in big quantities, then a reflection of technological progress. The market is oversupplied while the West is going electrical rather faster than had been expected. It is also a fact that the developing world is going down the electron route quite rapidly.

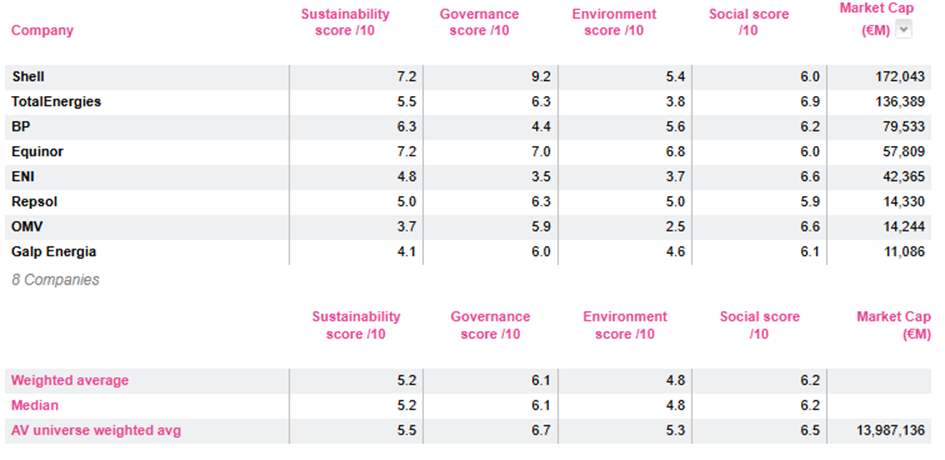

European Big Oil equity stories can be narrowed down to a) their cash extraction capabilities from existing assets and b) their speed of reinvestment in new energies which are essentially loss-making. This has proved choppy waters for BP and Equinor but much less so for TotalEnergies, Shell and ENI although question marks abound. In the end, the success of one and the failure of the other has been a measure of governance quality, a most surprising observation in an industry determined by its technological feats. Half decent governance is not a negative either when it comes to facing NGOs which have good questions but frustratingly focus on the oil industry even when the latter tries hard to improve.

AlphaValue closely tracks - in a consistent and dispassionate manner - the non financial metrics of any industry with comparisons in mind. Big Oils do better than their street image in this respect. This is not an investment brake.

Sustainability, Governance et al. for Big Oils

Reverting to financial items, Big Oils are cheap (see the following table) and offer a very decent yield against no earnings growth. That is part of the contract. The only question is whether the political upheavals triggered by the Trump administration will not turn out to backfire for the local industry bringing in much needed volatility. In that respect European Oils are diversified and presumably act as a broad insurance policy for future messy moments. We would be buyers into that c. 6% dividend return.

Big Oils valuation essentials

The markets have sorted out the conundrum by pushing prices lower: the consumer wins, for now.

Trump’s Brent back to a 3-year low at $70

Interestingly with or without Trump’s weird economics, European-listed Oils have fared comparatively well, i.e. in line with the index as it happens. Their share prices have proved to be not that impressed by the 2022 inflationary peaks of various energies.

Big Oils (blue) match the Stoxx600 over 5 years

The oil story shifted to one of natural gas and then to LNG as Russia disappeared from the supply picture. Crude or gas has always been a political story with OPEC holding more or less sway and essentially none when shale based molecules started to flow in big quantities, then a reflection of technological progress. The market is oversupplied while the West is going electrical rather faster than had been expected. It is also a fact that the developing world is going down the electron route quite rapidly.

European Big Oil equity stories can be narrowed down to a) their cash extraction capabilities from existing assets and b) their speed of reinvestment in new energies which are essentially loss-making. This has proved choppy waters for BP and Equinor but much less so for TotalEnergies, Shell and ENI although question marks abound. In the end, the success of one and the failure of the other has been a measure of governance quality, a most surprising observation in an industry determined by its technological feats. Half decent governance is not a negative either when it comes to facing NGOs which have good questions but frustratingly focus on the oil industry even when the latter tries hard to improve.

AlphaValue closely tracks - in a consistent and dispassionate manner - the non financial metrics of any industry with comparisons in mind. Big Oils do better than their street image in this respect. This is not an investment brake.

Sustainability, Governance et al. for Big Oils

Reverting to financial items, Big Oils are cheap (see the following table) and offer a very decent yield against no earnings growth. That is part of the contract. The only question is whether the political upheavals triggered by the Trump administration will not turn out to backfire for the local industry bringing in much needed volatility. In that respect European Oils are diversified and presumably act as a broad insurance policy for future messy moments. We would be buyers into that c. 6% dividend return.

Big Oils valuation essentials

Subscribe to our blog

A week ago, Reckitt posted splendid Q3 sales lifted by emerging markets demand, while L’Oré...

AlphaValue resuscitated its 20-year Ebitda margin chart (ex Banks and Deep Cyclicals) and continu...