Dip buying, again

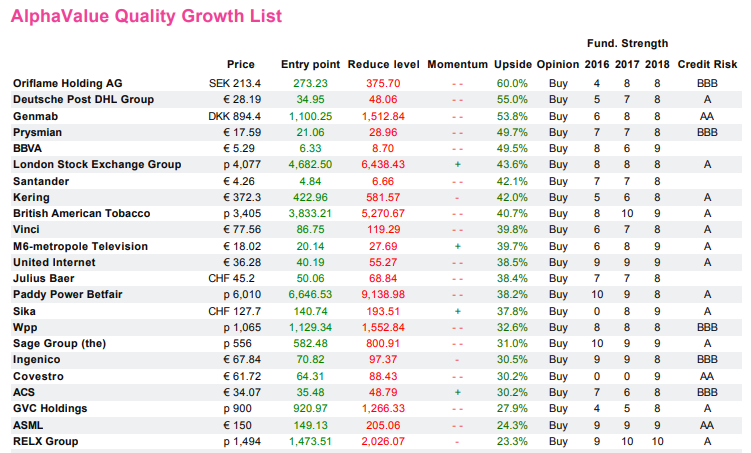

The last few days' storm has opened wide BUY opportunities. We contribute here a list concentrating on quality names, i.e. more of a growth profile and with stainless-steel balance sheets.

The filtering combines attention to their fundamental strength (resilience of business models, 0 to 10 scale, 10 is best), their credit risk /balance sheet, superior upside potential and the fact that these stocks are currently trading below a technical entry point.

It is a cold-blooded exercise so that Sika (not much of a disagreement here) will sit next to stocks which are much more discussed (Oriflame, Metropole TV, Sage, WPP, BAT, etc.).

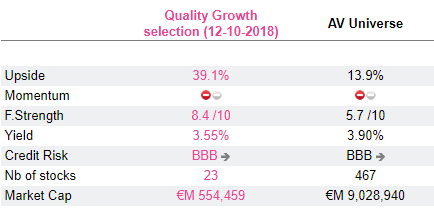

For anyone considering buying in bulk, here are useful perspectives about the above universe tracked on an equal basis. It looks like a no-brainer with a 39% upside potential.

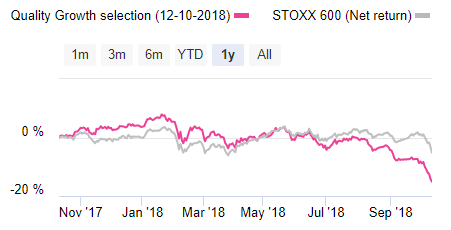

1-year performance

For anyone considering buying in bulk, here are useful perspectives about the above universe tracked on an equal basis. It looks like a no-brainer with a 39% upside potential.

1-year performance

Combined fundamentals

Combined fundamentals

Subscribe to our blog

AlphaValue has certainly not been alone over the last 4 months in wondering when too much was to...

A week ago, Reckitt posted splendid Q3 sales lifted by emerging markets demand, while L’Oré...