Time To Book Defence Profits?

The AlphaValue coverage of Aerospace & Defence was bound to become defence driven as we suggested … 2 years ago. It happened.

Still the sector is off to a surprisingly strong 2026 start. Non Ukrainian defence matters led the sector up 12.5% ytd (to 9-01 close), while the AlphaValue coverage does not even allow for Saab up 30% ytd, nor Hensoldt up 26%.

Defence surge

Having Maduro sharing a bed in a US jail, kicking the Danes out of Greenland, or seizing a rusted Russian tanker on the high seas, is not enough of a trigger for such a bout of enthusiasm. Conversely peace talks in Ukraine, while dragging, are not entirely dead, and should have acted as a cooler. They seem to be forgotten for now.

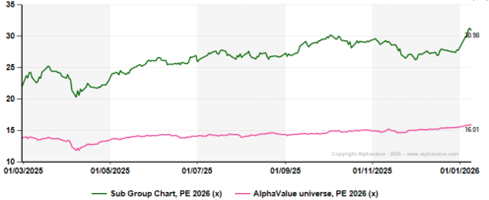

One wonders why the sector should be trading at 31x its 2026 earnings. It assumes that the 21% earnings growth is safe (see next table). This implies superb execution in a sector known for repeatedly falling by the wayside.

Aerospace & Defence valuation essentials

When the sector PE moved from 15x to 25x by late 2024 we were supportive of taking the risk. At 31x for 2026, there may be a case for cashing out, at least partially.

2026 Aerospace & Defence PE (green) vs. market PE (pink) – last 9 months

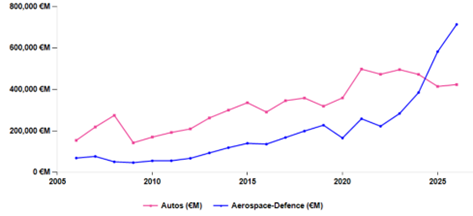

And this chart comparing the market cap of Autos (pink) and A&D (blue) will also speak for itself.

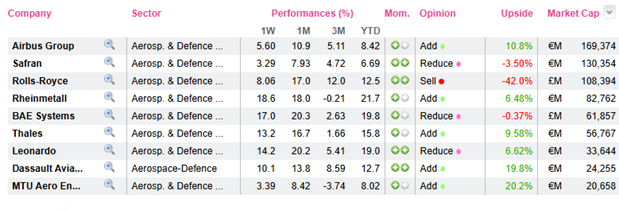

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airbus as a structural holding, it is clear that booking profits on Rolls-Royce and Rheinmetall are good starting points.

Still the sector is off to a surprisingly strong 2026 start. Non Ukrainian defence matters led the sector up 12.5% ytd (to 9-01 close), while the AlphaValue coverage does not even allow for Saab up 30% ytd, nor Hensoldt up 26%.

Defence surge

Having Maduro sharing a bed in a US jail, kicking the Danes out of Greenland, or seizing a rusted Russian tanker on the high seas, is not enough of a trigger for such a bout of enthusiasm. Conversely peace talks in Ukraine, while dragging, are not entirely dead, and should have acted as a cooler. They seem to be forgotten for now.

One wonders why the sector should be trading at 31x its 2026 earnings. It assumes that the 21% earnings growth is safe (see next table). This implies superb execution in a sector known for repeatedly falling by the wayside.

Aerospace & Defence valuation essentials

When the sector PE moved from 15x to 25x by late 2024 we were supportive of taking the risk. At 31x for 2026, there may be a case for cashing out, at least partially.

2026 Aerospace & Defence PE (green) vs. market PE (pink) – last 9 months

And this chart comparing the market cap of Autos (pink) and A&D (blue) will also speak for itself.

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airbus as a structural holding, it is clear that booking profits on Rolls-Royce and Rheinmetall are good starting points.

Subscribe to our blog

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...