Novo Nordisk

Note: This is a daily stock update and the information stands true as of 01/04/25, 09:00 CET.

Company Update:

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

Novo Nordisk is fortifying its obesity arsenal. Just days after inking a licensing agreement with China-based The United Laboratories for an obesity drug candidate, Novo has now entered into a licensing deal with US-based Lexicon Pharmaceuticals for an early-stage weight-loss drug candidate and the deal is worth up to $1bn (o/w only $75m would be paid upfront and the remaining in milestone-based payments).

For our analyst, this is a very strong deal and the combination of Lexicon key drug and Wegovy could make wonders, notably preventing obese patients to regain weight.

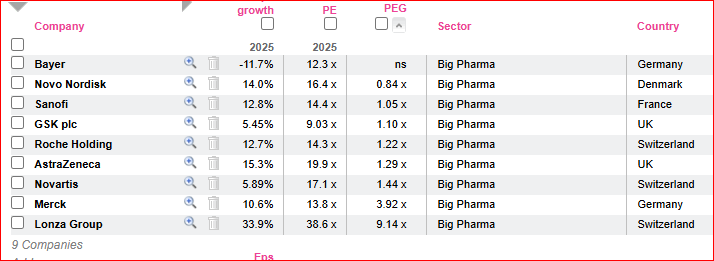

Overall, the competition in weight-loss drugs market is intensifying and we could see newer benchmarks being set in the next few years in terms of efficacy and tolerability (i.e. lower side-effects). As far as Novo’s valuation is concerned, after correcting >50% since June 2024 – on account of competition concerns, pricing pressure and R&D challenges – the shares trade at a 2025e P/E of 16.6x, which is lower than that of Novartis and AstraZeneca, despite Novo PEG ratio being the lowest amongst AV Big Pharmas.

Expert Opinion: The valuation looks very attractive indeed after the disastrous performance of the stock. We still expect Novo to post the best EPS growth over 2025 and 2026 (with the exception of Lundbeck) within the sector with EPS expected to grow 14% in 2025 and 22% in 2026. Overall our PEG for Novo stands at 0.84x.

Our only concern is about trigger. There are concerns that the group could narrow its guidance lower when it releases its Q1 earnings. However, we believe that if it happens it is likely to be marginal. Novo is also the potentially most exposed stock to the Trump administration threats. Indeed, if the situation worsens between the US and Denmark regarding Greenland, Novo could be an easy target. At current share price, we believe these risks are already very much priced in. Novo is a clear Buy and hold in our opinion.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog

Alphavalue Morning Market Tip

Strong results across the board - 9% shareholder yield is attractive.