Novartis

Note: This is a daily stock update and the information stands true as of 04/02/26, 09:00 CET.

Company Update:

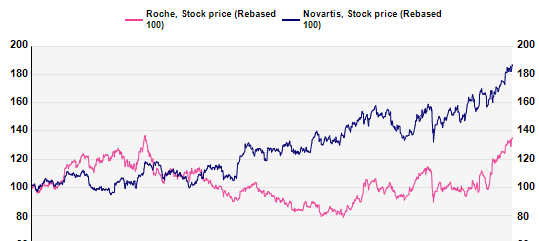

The 2026 guidance is quite unexciting. Novartis still trades at a nice premium to Roche (PE26 at 20.4x vs 16.7x) with less EPS growth (2.6% before revision, vs 11.3%). Our expert expects Roche to catch up vs Novartis (see below 5 y relative graph).

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

Sales came in at $13.3bn, down 1% at constant exchange rates (CER) but up 1% reported, due to FX tailwinds. NB, all growth figures are in CER terms, unless stated otherwise. COI increased 1% to $4.9bn. The strong performance in Oncology, Neuroscience and Immunology was offset by falling sales of heart failure drug Entresto (in CVRM), following its patent expiry in July 2025.

For 2025, sales and COI increased 8% and 14% to $54.5bn and $21.9bn, respectively. The Board proposed a dividend of CHF3.7/share (+5.7%), better than the AV estimate of CHF3.55/share.

For 2026, the management anticipates sales to increase by low single digit and COI to decline by low single digit percentage, respectively. The outlook is somewhat lower than the consensus expectations.

Overall, our model is under review, but we maintain our cautious stance on Novartis, which already trades at c.20% premium to the AV Big Pharma average in 2026e P/E (20.4x) terms. That said, we acknowledge Novartis’ healthy growth across key therapeutic areas, a large and well-progressing pipeline, a noteworthy R&D execution track record, and a healthy balance sheet (2026e net debt-to-EBITDA of 1.7x).

Expert Opinion:The 2026 guidance is quite unexciting. Novartis still trades at a nice premium to Roche (PE26 at 20.4x vs 16.7x) with less EPS growth (2.6% before revision, vs 11.3%). Our expert expects Roche to catch up vs Novartis (see below 5 y relative graph).

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog

Alphavalue Morning Market Tip

Strong results across the board - 9% shareholder yield is attractive.