L'Oréal

Note: This is a daily stock update and the information stands true as of 23/10/24, 09:00 CET.

Company Update:

Expert Opinion:

For daily updates, subscribe to our newsletter and for detailed daily updates, reach out to us at sales@alphavalue.eu

Company Update:

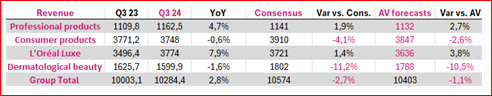

Q3 2024 total sales grew by 3.4% (2.8% reported) to €10.29bn, falling short of both consensus estimates and our expectations.

The weaker-than-anticipated trading environment in China (-6.5% like-for-like in North Asia) and the slowdown in dermatological beauty growth (+0.8% YoY), particularly in the US market, significantly impacted the group’s quarterly performance.

Sales in China declined by a high mid-single digit during the quarter.

While the group remains confident in the overall strength of the global beauty market, it acknowledged that the recovery trajectory of the Chinese market remains uncertain.

The company also estimated it will pay a €250m in tax due to the increase corporate tax rate in France.

The company also estimated it will pay a €250m in tax due to the increase corporate tax rate in France.

The continued slow momentum in China is a key feature. Expectations of continuing growth in China were baked in for L’Oréal as for many western high-end brands. The Chinese environment consumption is a lasting drag and there is a distinct possibility that Chinese consumers will eventually switch to local brands. Maybe more importantly, the miss in dermatological products, that was considered as a secure fast-growing segment with little competition, is worrying.

In all considering the current valuation (PE24 of 27.4x , PE25 of 25.6x and PE26 of 23.8x), I would stay away from the name.

Negative X read to Beiersdorf (reduce).

Negative X read to Beiersdorf (reduce).

Subscribe to our blog

Alphavalue Morning Market Tip

Strong results across the board - 9% shareholder yield is attractive.