Informa

Note: This is a daily stock update and the information stands true as of 17/06/25, 09:00 CET.

Company Update:

Expert Opinion:

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

Informa just announced its AGM trading update which confirms continuing strong growth and reiterates its FY25 guidance.

5M figures:

Revenue grew by 7.9% organically, thus ahead of the 5%+ guidance.

The group already has visibility on c.£2.8bn of revenue, representing 70% of the guidance.

However, the organic revenue growth is boosted by the continuous signing of non-recurring licensing agreements with AI companies for its publishing division (+13.7% organic growth but 3-4% for core business as usual, in line with guidance).

In B2B live events, the performance was good with 8.3% organic growth driven by the Gulf incursion notably, ahead of the 7%+ guidance

The performance of Informa TechTarget was unsurprisingly underwhelming at -5% organic growth (low-mid single decline digit guidance for H1) given the consolidation mess, although the group is seeing improvement in Q2.

The guidance was slightly downgraded for the EPS from double-digit to 10%+/- but this is due to the weakening of the US dollar and is thus not an issue per se.

This is reassuring as while the slight downgrade EPS guidance was expected but the signing of more AI licensing deals probably wasn't expected and B2B events bookings seem unaffected by macroeconomic uncertainties, at least so far.

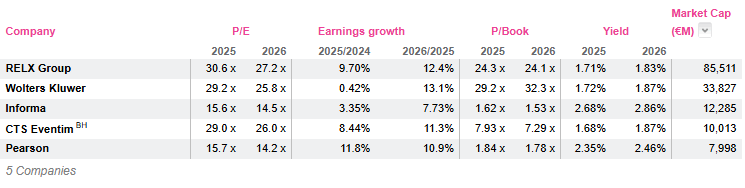

Positive cross-read for RELX and to a lesser extent Wolters Kluwer whose valuations seem attractive considering their intrinsic qualities.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog

Alphavalue Morning Market Tip

Strong results across the board - 9% shareholder yield is attractive.