Glencore, Rio Tinto

Note: This is a daily stock update and the information stands true as of 09/01/26, 09:00 CET.

Company Update:

We have attached the June note, which gave the rationale for the deal. Our expert would argue that since then the negative spin on the coal assets is likely to be less than it was.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Company Update:

Rio Tinto and Glencore are again discussing a $260bn mega-merger. This time the talks seem serious as both have confirmed that they are in ‘preliminary discussions’.

After last talks failed in late 2024, Glencore’s decision to restructure its coal assets under one unit in Australia in mid-2025 was a clear signal that the Swiss giant was preparing to be ready for a merger with Rio. Details were covered in our note titled “Is the Rio-Glencore merger still on?” dated 6 June 2025. Thereafter, unconfirmed news of Chalco wanting to exit Rio by taking over some of the latter’s key assets (like Simandou and Oyu Tolgoi) further added to the Rio-Glencore merger preparation.

Remember, if Chalco takes over Oyu Tolgoi, anti-trust issues could be limited on the copper side – which would be closely watched by all regulators.

Also, with BHP on weak footing – after various failed Anglo American takeover attempts, which may perhaps trigger search for a new ‘external’ CEO, Rio-Glencore merger talks couldn’t have happened at a better time.

Overall, odds of a deal are much bigger (vs. past instances) as both of them are clear in maintaining their UK listing status, and it’s likely to be an all-share deal, considering the sharp appreciation in both firms’ shares.

Although Rio’s shares have fallen c.6% in Australian markets today and a similar reaction could be witnessed in the UK markets, even for the likes of Glencore - as deals of this scale tend to spook investors. But since there are clear benefits in a deal, we maintain a positive outlook for both firms, which are also amongst our preferred bets for this year.

Expert Opinion:We have attached the June note, which gave the rationale for the deal. Our expert would argue that since then the negative spin on the coal assets is likely to be less than it was.

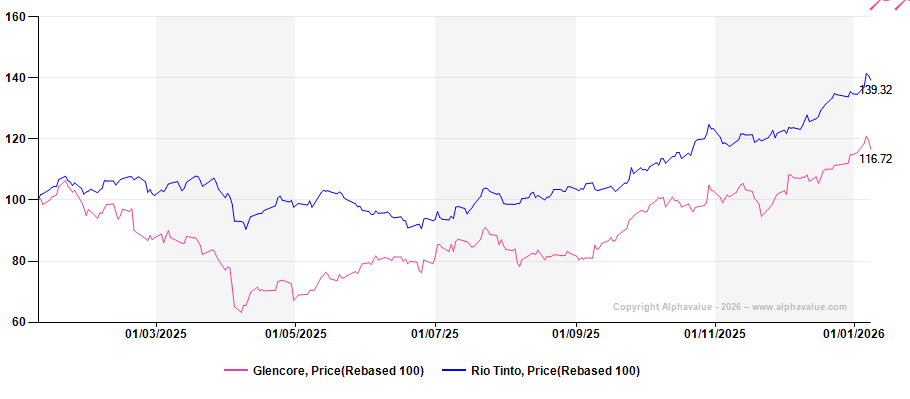

Since the talks failed around a year ago, Glencore has been substantially underperforming Rio Tinto. He expects a catch-up in the next few days with Glencore outperforming Rio. The deal makes a lot of sense strategically. Glencore remains his favorite diversified company in the sector. Let us know by contacting sales@alphavalue.eu if you want to book a call with our analyst, our head of metals and mining, who is highly knowledgeable on the sector.

For daily updates, subscribe to our newsletter and for detailed information, reach out to us at sales@alphavalue.eu

Subscribe to our blog

Alphavalue Morning Market Tip

Likely to be massively impacted by Lidl's decision to stop ads on French TV.